Search Questions

The Benefits of Fractional NFTs

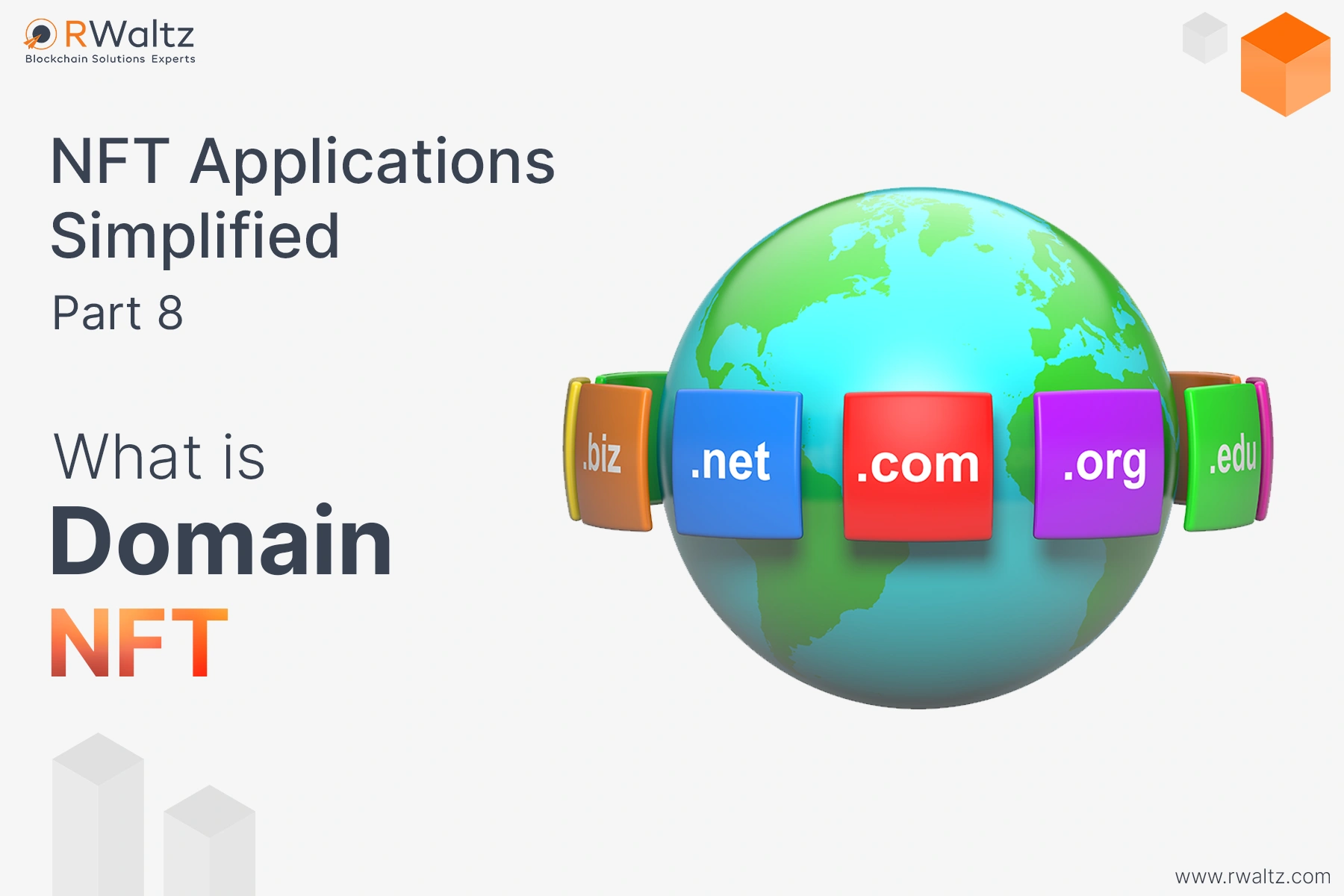

Non-fungible tokens (NFTs) have exploded in popularity over the past few years. From digital art and collectibles to virtual real estate and gaming assets, NFTs are shaking up multiple industries. However, the high prices of desirable NFTs put them out of reach for many people. This is where fractional NFTs come in.Fractional NFTs allow people to own a portion of an NFT, making them more accessible and opening up new opportunities. In this blog post, we’ll explore what fractional NFTs are, their use cases, and the benefits they offer compared to whole NFTs.What are Fractional NFTs?A fractional NFT represents partial ownership of an NFT. Let's say there is a rare CryptoPunk NFT worth $100,000. This is far too expensive for most people to afford.With fractional NFTs, that single CryptoPunk can be divided into smaller pieces, like 100 shares worth $1,000 each. Now, 100 different people can each own 1/100 of the CryptoPunk NFT.So in summary: Fractional NFTs split a single NFT into multiple shares or tokens Each fractional token represents partial ownership of the underlying NFT Owners of fractions share rights to the NFT based on the percentage they ownThis opens up NFT investing and collecting to more people by reducing the buy-in cost.What is an Example of a Fractional NFT?One of the most well-known fractional NFT platforms is Fractional. art.Here's an example of how it works: An artist mints an NFT of their artwork called "Golden Gate Bridge" The NFT is listed on Fractional. art for $100 Fractional. art programmatically splits the NFT into 100 fractions each worth $1 Collectors can buy the fractional tokens on the platform with a minimum purchase of $1 Ownership and rights to the underlying NFT are divided based on the number of fractions each collector holdsSo instead of one person owning the "Golden Gate Bridge" NFT for $100, now 100 people can own a piece of it for just $1 each. This makes the artwork much more accessible.Many other fractional NFT platforms work on similar principles, slicing up digital assets into more affordable pieces.What is the Use Case of NFT Real Estate?One of the most promising use cases for fractional NFTs is virtual real estate. Full virtual land NFTs can be extremely expensive, with premium plots going for hundreds or even millions of dollars.Fractional real estate NFTs allow investors to buy into coveted areas like Metaverse boroughs or virtual world parcels at a lower cost. Even owning 1% of a highly-valued piece of virtual land could be lucrative as the metaverse grows.For example, Republic Realm bought a virtual Atari gaming world called Atari Island in Decentraland for $900,000. They fractionalized it into parcels, with the cheapest plot costing around $20. This allowed over 1,600 individual investors to get a piece of the valuable metaverse land.Virtual real estate is still speculative, but fractional NFTs make it possible for more people to get exposure to this emerging digital asset class. The fractions can be traded freely, creating secondary market opportunities.What is a Fractionalized NFT?Fractionalized NFTs and fractional NFTs refer to the same concept - splitting an NFT into smaller ownership shares.Some key points about fractionalized NFTs: The fractions act as ERC-20 tokens on Ethereum, while the underlying NFT is an ERC-721 token The fractions represent ownership rights and access to the original NFT based on the percentage owned Fractionalized NFTs allow shared ownership of NFTs without having to split the asset itself On-chain standards like ERC-1155 (multi-token standard) enable NFT fractions functionalityFor example, fractionalized CryptoPunks are ERC-20 tokens that represent partial ownership of CryptoPunk NFTs. Each fraction tracks ownership of the punk graphic, commercial rights, and the ability to display it.Fractionalizing creates smaller bite-sized tokens rooted in scarcer assets like top NFT collections, metaverse land, and more.What is an Example of a Fractional Share?Fractional shares are a traditional finance concept similar to fractional NFT ownership.With stocks, fractional shares represent owning part of a single share of stock.For example: Company XYZ is trading at $500 per share An investor buys 0.5 fractional shares for $250 They now own half of one full $500 share The investor gets dividend payments based on owning 50% of a shareFractional stock programs from brokerages like Robinhood, SoFi, and Charles Schwabb increase equity access for small investors. Someone with just $100 can own slivers of expensive stocks like Amazon.Similarly, fractional NFTs split expensive digital assets into accessible bite-sized interests. Owning 0.1 of a rare NFT can be easier than affording a whole one.Both fractional shares and NFTs benefit smaller investors by removing high entry barriers. Fractional ownership is a powerful concept that's expanding from stocks to alternative assets.What is an Example of Fractional?Here are some common examples of fractional ownership and assets: Fractional real estate - own part of a property through crowdfunding Fractional art - own sections of a large piece of art Fractional sports cards - own fractional interests in rare collectibles Fractional stock shares - own portions of full shares Fractional NFTs - own percentages of NFTs Timeshares - shared ownership of vacation properties Fractional yacht ownership - co-own and share yachts Fractional private jets - own hours on a private jetAnything scarce and expensive can potentially be fractionalized. This makes ownership more flexible, accessible, and liquid. Instead of one person owning something outright, fractions enable shared ownership.Benefits of Fractional NFTsNow that we've covered the fractional NFT basics, let's dig into the unique advantages they offer compared to whole NFTs:More Affordable Entry PointThe number one benefit of fractional NFTs is reduced cost. As we saw earlier, dividing a $100,000 NFT into 1,000 $100 fractions drastically lowers the buy-in price.Affordability opens up investing and collecting opportunities to more individuals. Whole NFTs with high price tags can exclude many from participating.Fractional NFTs have no minimum investment amount. Platforms let people own fractions starting at just a few dollars. This is perfect for small investors and collectors.Access to Rare and Elite NFTsAnother major perk is accessibility to rare blue chip NFTs. Items like Bored Apes and CryptoPunks are attainable only for wealthy crypto holders. Their prices can run into the millions!With fractionalization, anyone can own a piece of elite NFTs. Every day investors couldn't dream of buying a whole $200k CryptoPunk. But snagging a 0.5% fraction is possible and offers exposure to a top brand.Platforms focusing on blue-chip NFT fractions give broader access to sought-after digital assets. The ability to own fractions of rare collectibles adds more diversity to portfolios.Greater LiquidityFractional NFTs tend to be more liquid than whole NFTs. It's easier finding buyers for smaller $50 or $100 fractions than $50k+ full NFTs.Lower transaction costs also improve liquidity. Trading a $100 fraction triggers much lower gas fees than transferring an entire NFT.With fractional real estate NFTs, for example, investors can cash out of individual parcels while keeping ownership in larger metaverse properties. This piecemeal liquidity isn't possible when holding full virtual land plots.Overall, the bite-sized and affordable nature of fractional NFTs attracts more users, buyers, and sellers. This results in more active secondary markets compared to many whole NFTs.Shared Ownership ExperienceOwning fractionals creates a shared experience around coveted NFTs. Instead of a single whale owning an asset, a community of holders share rights.Fractional platforms often have social features that let fraction holders chat, collaborate, and jointly manage assets. Shared custody can make owning NFTs more fun and engaging.For real-world collectibles like cars or watches, fractionalization enables new social dynamics. Small groups can co-own an asset and coordinate sharing it.Shared interests strengthen communities around valuable NFTs and digital goods. This communal aspect is unique to fractionals.Potential for Investment GainsAlthough risky and speculative, fractional NFTs offer investment upside potential. If the value of the underlying NFT rises, the increased demand applies to all fractions.Let's say you own 1% of a fractionalized Bored Ape currently valued at $300k. If that Bored Ape later sells for $500k, your 1% stake price effectively doubles as well.Despite just owning a sliver, your fractional interest gains value aligned with the NFT itself. This turns fractions into leverageable plays on rising blue chip prices.Governance RightsMost fractional NFT platforms grant governance rights proportional to the percentage owned. Major decisions about the underlying NFT are put to a fractional holder vote.For example, owners of a fractionalized metaverse parcel could vote on whether to develop virtual buildings on the land. This ability to weigh in on asset use cases isn't possible when owning tiny slivers of stocks.Allowing fractional owners to vote, make proposals, and share management decisions helps engage the community. It also reduces centralized control by fractional platforms.Overall - More Participation in Web3At a high level, fractional NFTs promote wider participation in web3 and decentralized ownership models. By lowering buy-in costs, fractionalization makes the blockchain more inclusive.With whole NFTs and many tokens, wealth tends to concentrate among a few early movers and crypto whales. Fractionals enable a more distributed user base to benefit from digital asset growth.For creators, fractional NFTs unlock new direct-to-consumer revenue streams. Fans can directly support artists and causes by buying affordable tokenized creations.Widely available fractional NFT investing and collecting could be a game changer for mass Web3 adoption.Evaluating Fractional NFT PlatformsAs fractional NFTs gain traction, more platforms are launching to allow minting and trading fractions. Here are some key factors to evaluate:Security - Does the platform use leading security and custody solutions?What measures prevent fractional scams? Team - The team's blockchain expertise and track record with asset fractionalization. Underlying Asset Quality - Top platforms secure rare, sought-after NFTs and virtual lands for fractionalization. Community Trust - Strong support and usage from collectors, metaverse enthusiasts, and NFT influencers. Ease of Use - Smooth onboarding, accessible trading, and intuitive user experience even for crypto newcomers. Social Features - Ways to engage with other fraction holders like forums and collaborative management. Fees - Fractional platforms should charge reasonable fees for minting, transactions, and other services. Technical Implementation - Ideally utilizes standards like ERC-20, ERC-721, and ERC-1155 to integrate well across web3 apps.The fractional NFT space is still young and evolving. But picking trusted platforms with strong technical chops and community ties is key, like with any crypto sector.ConclusionFractional NFTs expand access and open up opportunities in Web3. By splitting expensive blue chip NFTs into more attainable pieces, fractionals enable broader participation. While risky as a speculative asset class, fractional NFTs allow smaller investors to gain exposure to rare digital goods.We've only scratched the surface of use cases like fractional virtual real estate and collectibles. New metaverse and NFT projects can consider fractionalization to drive consumer adoption. Overall, fractional ownership models have the potential to make Web3 more inclusive.Consider adding fractional NFTs as a small portion of your crypto portfolio. Shop for deals, track promising collections and join vibrant communities co-owning coveted digital assets. Just like their whole counterparts, fractional NFTs are an exciting new frontier.NFT Marketplace Development is one of the promising blockchain development services to help brands kick-start their journey in the NFT space.

Demystifying Token Standards: A Beginner's Guide to Finding the Right Fit for Your Blockchain Project

Starting a blockchain project can feel overwhelming with all the technical decisions you need to make. But experienced folks in the space know one of the most important choices is picking the right token standard. This will shape what your token can do and how it works within the blockchain ecosystem.So how do you wrap your head around choosing as a blockchain newbie? This guide aims to walk through the key considerations in straightforwardly help you find the optimal standard for your project goals.Introduction to Token StandardsEssentiallyToken Standards are rules and functions that enable tokens to operate on a blockchain network. The ERC-20 standard lays out how to create fungible tokens on Ethereum. Fungible just means each token is identical and interchangeable, like dollars. The ERC-721 standard defines how to build non-fungible tokens (NFTs) with unique attributes. Think of them like rare collectibles.Overview of Standards on Different BlockchainsNow different blockchains have their specialized standards based on their capabilities. Ethereum has robust options like ERC-20, ERC-721, ERC-1155 and more. Binance Smart Chain copies Ethereum’s style with standards like BEP-20 and BEP-721. Other players like Cardano, Polkadot, Tron, and Solana - have all customized standards optimized for their networks.How to Choose the Right Standard - Step-by-StepSo where do you start in picking the right one? Here’s a step-by-step approach: Project Requirements Assessment: First, reflect on your project’s goals and needs. Are you looking to create a utility token that can be traded interchangeably? Or unique digital collectibles? Outlining core requirements like that gives you direction. Interoperability Needs: Next, think about if you need to interact with other blockchains. For example, if you want users to easily trade tokens across different exchanges, standards like TRC-20 or BEP-20 enable better cross-chain abilities. Ecosystem and Community Support: Do some research on which ecosystem best aligns with your project’s path. Ethereum has rich developer resources, tools, and educational materials to leverage. But for some use cases, a newer ecosystem like Solana focused on speed may suit you better. Community Engagement: Evaluate each standard’s community support. An engaged community actively building, communicating, and sharing helpful materials can really uplift your project’s experience. Future-Proofing and Evolution: Consider future-proofing too. More advanced standards like ERC-777 have cool features like meta transactions that you may want down the road. Newer ones are still maturing so do your homework. Platform Considerations: Remember that each blockchain has unique capabilities around fees, transaction speeds, security, etc. Make sure the one you choose matches your technical needs. Consult with Experts: If you’re still unsure, talk to blockchain experts. Their experience can help connect the dots on which standard checks all your boxes.Let’s solidify this with a few real-world examples:Say you’re creating a decentralized crypto exchange. You’ll need a fungible token for trading between users, so ERC-20 or BEP-20 would fit. But you also want users to easily trade across other exchanges. So opting for cross-compatible standards like BEP-20 or TRC-20 makes sense.Alternatively, if you're building a platform for artists to mint digital collectibles, you'll want to prioritize NFT functionality. ERC-721 is a good match here since Ethereum already has a thriving NFT ecosystem.Or maybe you're developing an NFT trading card game that requires unique tokenization for individual cards but also fungible tokens for in-game currency. ERC-1155 supports both NFTs and fungible tokens in one standard - very handy!As you can see, really evaluating your project’s needs and researching your options is crucial for identifying the right token standard. The blockchain space changes rapidly so take the time to fully understand your project before committing. And don’t hesitate to pick the brains of experts like the team at RWaltz - their experienced perspectives can illuminate things you may have overlooked.While the array of token standards seems overwhelming at first, breaking down your project goals methodically will reveal the perfect choice. The standard you select lays the foundation for your product. Put in the legwork early on to make an informed decision - it’ll pay off as your project grows and gains users. And partner with seasoned teams who can steer you toward the optimal standard for your project’s specific needs.If you're seeking professional guidance and expertise in Token Development services, our experienced team is here to assist you in making the most informed decisions for your blockchain project. Feel free to reach out to us for tailored advice and support on your tokenization journey.

250+ Gaming NFT Ideas to Engage the Users

Non-fungible tokens (NFTs) have exploded in popularity over the last couple of years, especially in the gaming industry. Major gaming companies and indie developers are rushing to incorporate NFTs into games as players seek to truly own unique in-game assets. NFTs represent ownership of digital items like character skins, weapons, real estate parcels, and more. But coming up with fresh gaming NFT ideas that resonate with players requires strategic thinking. In this post, we’ll explore innovative gaming NFT ideas and opportunities to consider.From exclusive collectibles to customized creations, explore fresh ways to reward players and boost engagement through non-fungible tokens Ownership and Scarcity: NFTs grant gamers true ownership of in-game assets, fostering a sense of rarity and exclusivity, which can lead to increased player engagement and value perception. Interoperability and Cross-Game Utility: NFTs can be utilized across multiple games, allowing players to carry their assets and achievements from one game to another, creating a seamless gaming experience. Player-Driven Economies: NFT-enabled gaming platforms empower players to create, buy, and sell in-game assets, fostering player-driven economies that can stimulate engagement and create a sense of entrepreneurship. Gamified Collectibles: Introducing NFT-based collectibles, such as character skins, weapons, and accessories, encourages players to engage in specific activities or challenges, driving gameplay and competition. Exclusive Events and Rewards: NFTs can serve as rewards for completing in-game achievements or participating in special events, incentivizing users to immerse themselves further in the gaming world. Limited Edition Content: Offering limited edition NFTs with unique attributes can drive anticipation and excitement among players, boosting engagement and participation in time-sensitive activities. Collaborative Creation: NFTs enable the collaborative creation of in-game content by players, including custom levels, mods, and virtual real estate, fostering a strong sense of community and shared ownership. Celebrity Partnerships: Partnering with celebrities or influencers to release exclusive NFTs can attract new players and create buzz, expanding the user base and increasing engagement. Real-World Value: The ability to trade NFTs on external marketplaces can attract collectors and investors, adding a layer of real-world value to in-game assets and increasing engagement. Limited-Time Events: Hosting time-limited NFT events, where players can earn or purchase unique assets, can create a sense of urgency and drive consistent user participation. Dynamic Gameplay Mechanics: NFTs can introduce dynamic gameplay mechanics, where the attributes of in-game assets can influence player performance, strategy, and outcomes. Enhanced Social Features: Integrating NFTs with social features, such as gifting or trading assets with friends, can foster a sense of camaraderie and social interaction among players. Player-Centric Monetization: NFTs allow gamers to monetize their skills and time investment by selling valuable assets, providing an additional incentive for engagement and dedication. Localized Events and NFTs: Creating region-specific NFTs or events can cater to the preferences of different player communities, increasing engagement among diverse user groups. Lore and Storytelling: NFTs can be tied to the game's lore and storytelling, enticing players to uncover hidden narratives and explore the game's world in-depth. NFT-Backed Competitions: Hosting competitive events where players wager or stake NFTs can amplify the player engagement, turning gameplay into a high-stakes, immersive experience. Dynamic Crafting Systems: Introducing NFT-based crafting systems, where players combine assets to create unique items, adds a layer of complexity and strategic thinking to the gaming experience. Seasonal and Thematic NFTs: Releasing NFTs that align with seasonal themes or game updates can maintain user interest over time and encourage continuous engagement. Virtual Land Ownership: Implementing NFT-based virtual land ownership can stimulate player creativity and collaboration, driving engagement through user-generated content. In-Game Governance: Allowing NFT holders to participate in decision-making processes regarding game updates or changes can empower players and strengthen their connection to the game. Emergent Gameplay Possibilities: NFTs can unlock emergent gameplay possibilities, where players discover new strategies or interactions through the unique attributes of their assets. Charitable Initiatives: Introducing limited edition NFTs tied to charitable initiatives can not only engage players but also contribute positively to real-world causes. Educational NFTs: Using NFTs to offer educational content, tutorials, or guides can incentivize players to learn and improve their skills, enhancing engagement and retention. Personalized Avatars and Customization: NFTs allow for highly personalized avatars and customization options, encouraging players to express their individuality and engage with the game on a deeper level. Augmented Reality (AR) Integration: Integrating NFTs with AR technology can create unique, interactive experiences that bridge the gap between the virtual and physical worlds, driving user engagement. Player-Generated Challenges: Allowing players to create and share challenges or quests using NFTs can foster a sense of community and competition, encouraging ongoing engagement. Virtual Fashion and Lifestyle: NFTs can introduce virtual fashion and lifestyle elements, such as clothing, accessories, and virtual spaces, allowing players to curate their digital personas and enhancing engagement. Localized NFT Economies: Creating localized NFT economies based on specific regions or cultures can cater to diverse player preferences and amplify engagement within targeted communities. Time-Limited NFT Events: Hosting time-limited NFT events, auctions, or sales can create a sense of urgency and exclusivity, encouraging players to participate actively during specific periods. NFT-Backed Tournaments: Organizing tournaments where NFTs act as rewards or entry tokens can boost competitive engagement and drive participation among skilled players. Integrated Blockchain Mini-Games: Incorporating mini-games or challenges that utilize blockchain technology and NFTs can diversify gameplay and maintain player interest. Dynamic Narrative Choices: NFTs can influence the branching narratives and choices within the game, encouraging players to explore different paths and enhancing replayability. VIP and Loyalty Programs: Rewarding long-term players with exclusive NFTs as part of VIP or loyalty programs can foster a strong sense of dedication and continuous engagement. Dynamic NFT Events: Introducing NFT events that respond to real-world events or trends can create a dynamic and relevant gaming experience that resonates with players. Player-Centric Marketplaces: Implementing NFT marketplaces where players can easily buy, sell, and trade assets can create a vibrant ecosystem that encourages engagement and interactions. NFT Challenges and Quests: Incorporating NFT-based challenges and quests within the game can prompt players to explore different aspects of the game world and interact with diverse content. Live NFT Showcases: Hosting live showcases or events where players can exhibit their rare or unique NFT assets can drive community engagement and create a sense of prestige. NFT-Enhanced Virtual Events: Using NFTs to enhance virtual events, such as in-game concerts or exhibitions, can draw players into immersive experiences and amplify engagement. Player-Generated Content Marketplace: Creating a marketplace where players can sell their self-generated NFT-based content, such as artwork or mods, can incentivize creativity and deepen engagement. Cross-Platform NFT Integration: Enabling NFTs to be seamlessly integrated across different gaming platforms and devices can broaden player engagement and accessibility. NFT-Enabled Achievements: Assigning NFTs as rewards for completing challenging in-game achievements can motivate players to strive for excellence and maintain engagement. Personalized Storylines: NFTs can introduce personalized storylines and interactions based on a player's acquired assets, creating a tailored and immersive gameplay experience. Seasonal NFT Challenges: Offering seasonal NFT challenges or competitions can encourage players to participate actively during specific times, injecting freshness and excitement into the gaming environment. Community-Driven NFT Events: Involving the gaming community in the creation and execution of NFT events can enhance player engagement and foster a sense of ownership. Evolving NFT Mechanics: Implementing NFTs with evolving attributes that change over time or based on player actions can intrigue players and incentivize continuous engagement. NFT Leaderboards and Rankings: Integrating NFT-based leaderboards and rankings can spark healthy competition among players, driving them to improve and engage more deeply with the game. Narrative-Driven NFTs: Designing NFTs with embedded narratives or lore can captivate players, enticing them to explore the game world and uncover hidden stories. NFT-Infused Challenges: Designing challenges or quests that require the use of specific NFT assets can introduce a layer of strategy and decision-making, enhancing player engagement. Time Capsule NFTs: Offering time capsule NFTs that unlock unique content or benefits after a certain period can encourage players to remain engaged over the long term. Interactive NFT Auctions: Hosting interactive NFT auctions within the game can generate excitement, encourage player participation, and create memorable in-game events. Dynamic NFT Ecosystem: Designing an evolving NFT ecosystem with regular updates, additions, and events can ensure a continuous stream of engaging content for players. NFT-Powered Social Features: Enabling players to showcase their NFT assets in social spaces within the game can foster a sense of community and create opportunities for interaction. Emerging Gameplay Strategies: NFTs can introduce emergent gameplay strategies that require players to adapt and evolve their tactics based on the attributes of their assets. NFT-Driven Lore Expansion: Using NFTs to expand the game's lore and world-building can pique player curiosity and prompt them to delve deeper into the game's narrative. NFT-Based Time Trials: Introducing NFT-based time trials or challenges where players use specific assets to compete for records can create an engaging competitive environment. Localized NFT Lore: Creating region-specific NFTs with unique lore and significance can resonate with players from different cultures and backgrounds, driving engagement. Limited Edition NFT Quests: Designing limited edition NFT quests with unique rewards can create a sense of urgency and anticipation, motivating players to participate actively. NFT-Enhanced Mini-Games: Introducing mini-games or activities that utilize NFT assets can diversify gameplay and provide players with new avenues for engagement. Integrated NFT Storytelling: Weaving NFT-based storytelling elements into the game's main narrative can captivate players and encourage them to explore the game's lore. Exclusive NFT Partnerships: Collaborating with renowned artists or brands to release exclusive NFTs can attract attention, elevate the game's status, and drive engagement. NFT-Infused Competitions: Hosting NFT-powered competitions, where players wager or stake assets, can elevate the competitive intensity and engagement within the gaming community. Dynamic NFT Market Dynamics: Implementing NFT market dynamics that mirror real-world supply and demand can create an authentic and engaging trading experience for players. Localized NFT Events: Tailoring NFT events to specific geographic regions or cultural celebrations can foster a sense of inclusivity and encourage participation. NFT-Driven Puzzles: Designing puzzles or mysteries that require the use of NFT assets to unlock solutions can engage players' problem-solving skills and intrigue. Time-Limited NFT Challenges: Introducing time-limited NFT challenges that align with special occasions or milestones can generate excitement and attract player participation. NFT Story Branching: NFTs can impact the branching paths and outcomes of the game's narrative, inspiring players to explore different choices and replicability. NFT Social Competitions: Organizing social competitions where players showcase their NFT assets in creative ways can foster community engagement and interaction. Interactive NFT Cosmetics: Offering interactive NFT cosmetics that respond to player actions or emotions can create a unique and captivating visual experience. NFT-Powered Leaderboards: Integrating NFT-powered leaderboards that display rare or powerful assets can motivate players to strive for excellence and showcase their achievements. Dynamic NFT Trading: Introducing dynamic trading mechanics for NFT assets, such as auctions, bids, or peer-to-peer exchanges, can inject excitement and player interaction. Collaborative NFT Quests: Designing collaborative quests that require players to pool their NFT assets and skills can foster teamwork and encourage engagement. NFT-Enabled Personalization: Allowing players to personalize their gaming experience using NFT assets, such as customizable environments or avatars, can deepen engagement. Localized NFT Challenges: Creating localized NFT challenges that resonate with specific player demographics can drive engagement and cater to diverse interests. Dynamic NFT Lore Expansion: Releasing periodic NFTs that expand the game's lore and backstory can captivate players and prompt them to delve into the narrative. NFT-Enhanced Roleplaying: Using NFTs to enhance roleplaying experiences, such as unique character traits or abilities, can immerse players in their chosen roles and enhance engagement. Real-Time NFT Events: Hosting real-time NFT events or auctions that occur within the game environment can create a sense of urgency and encourage immediate participation. NFT-Gated Content: Introducing NFT-gated content or areas within the game that require specific assets for access can incentivize players to collect and engage with NFTs. NFT-Backed Social Challenges: Launching NFT-backed social challenges or trends within the gaming community can foster player engagement and spark creativity. NFT-Enhanced Exploration: Using NFTs to unlock hidden or exclusive areas within the game world can motivate players to explore and interact with different environments. Integrated NFT Rewards: Offering NFT rewards for completing in-game tasks or milestones can incentivize players to progress and engage with the game's mechanics. Emerging Competitive Strategies: NFTs can introduce emergent competitive strategies that require players to adapt their tactics based on evolving asset attributes. Localized NFT Economy Events: Hosting localized NFT economy events, such as regional marketplaces or auctions, can create tailored engagement opportunities. NFT-Infused Character Progression: Incorporating NFT assets into character progression systems can offer players unique growth paths and incentivize continuous engagement. Interactive NFT Questlines: Designing questlines where players must use specific NFT assets to uncover secrets or solve mysteries can engage players' curiosity and problem-solving skills. NFT Trading Competitions: Organizing trading competitions where players compete to build the most valuable NFT portfolio can foster engagement and strategic thinking. Dynamic NFT Events: Hosting dynamic NFT events that respond to player actions or achievements can create an immersive and rewarding gaming experience. NFT-Enhanced Crafting: Integrating NFTs into crafting systems, where specific assets yield unique item combinations, can encourage experimentation and engagement. NFT-Driven Exploration Challenges: Launching NFT-driven exploration challenges that encourage players to discover hidden treasures or locations can stimulate engagement. Localized NFT Lore Events: Creating NFT lore events that cater to different player communities or regions can spark interest and encourage diverse engagement. NFT-Backed Puzzles: Designing intricate puzzles that require the use of NFT assets to unlock solutions can engage players' critical thinking and problem-solving abilities. Time-Limited NFT Quests: Introducing time-limited NFT quests with exclusive rewards can generate a sense of urgency and motivate players to engage promptly. NFT-Powered Social Showcases: Allowing players to showcase their NFT assets in social spaces within the game can foster community engagement and interaction. Dynamic NFT Auctions: Hosting dynamic NFT auctions within the game environment can create excitement, encourage participation, and drive in-game events. Localized NFT Challenges: Designing challenges that cater to specific player demographics or cultural preferences can enhance engagement and inclusivity. NFT-Enhanced Progression: Using NFTs to enhance character progression systems, such as unlocking unique abilities or attributes, can incentivize ongoing engagement. Emergent NFT Strategies: NFTs can introduce emergent strategies that encourage players to adapt their tactics based on evolving asset attributes and interactions. Localized NFT Economy: Creating localized NFT economies or marketplaces that reflect regional preferences can foster engagement within targeted player communities. NFT-Infused Exploration: Using NFTs to unlock hidden areas or storylines within the game can motivate players to explore and engage with the game's content. Integrated NFT Competitions: Organizing competitions where players use NFT assets to compete for records or achievements can elevate engagement and competition. NFT-Enhanced Crafting Challenges: Introducing NFT-based crafting challenges that require specific assets to create unique items can stimulate engagement and creativity. Dynamic NFT Questlines: Designing questlines that dynamically evolve based on NFT assets used can create personalized and engaging narrative experiences. NFT-Backed Community Events: Launching NFT-backed events or competitions that encourage player creativity and interaction can enhance community engagement. Localized NFT Exploration: Creating NFT-based exploration challenges that resonate with specific player demographics or cultures can drive engagement. NFT-Powered Cosmetics: Using NFTs to offer interactive cosmetics that respond to player actions or emotions can create captivating visual experiences. Dynamic NFT Trading Mechanics: Implementing dynamic trading mechanics for NFT assets, such as live auctions or evolving marketplaces, can enhance engagement. Collaborative NFT Challenges: Designing challenges that require players to collaborate using NFT assets can foster teamwork and strengthen player engagement. Time-Limited NFT Rewards: Introducing time-limited NFT rewards for achieving specific milestones or in-game accomplishments can incentivize engagement. Interactive NFT Auctions: Hosting interactive NFT auctions or bidding events can generate excitement, encourage participation, and create memorable experiences. Localized NFT Events: Designing NFT events that align with local festivities or cultural celebrations can foster player engagement and inclusivity. NFT-Driven Puzzles: Incorporating NFT assets into in-game puzzles or mysteries can intrigue players and encourage exploration and critical thinking. Emergent NFT Storylines: NFTs can influence the branching paths and outcomes of the game's narrative, offering players dynamic storytelling experiences. NFT Social Competitions: Organizing social competitions or challenges where players showcase their NFT assets creatively can enhance community engagement. Integrated NFT Cosmetics: Offering NFT cosmetics that players can customize and interact with can enhance the visual experience and drive engagement. Localized NFT Challenges: Creating NFT challenges that cater to specific player preferences or regional interests can stimulate engagement within targeted communities. NFT-Enhanced Exploration: Using NFTs to unlock hidden or exclusive areas within the game world can encourage players to explore and engage with diverse environments. Player-Centric NFT Rewards: Offering NFT rewards for player-generated content, such as fan art or mods, can foster engagement and creative contributions. Dynamic NFT Events: Hosting dynamic NFT events or auctions that respond to player actions can create a sense of real-time immersion and engagement. NFT-Backed Personalization: Using NFT assets to personalize in-game avatars, environments, or items can deepen player engagement and customization. Emerging NFT Strategies: NFTs can introduce emerging competitive strategies where players adapt tactics based on evolving asset attributes. Localized NFT Economy: Implementing localized NFT economies or marketplaces that cater to specific player communities can encourage engagement. NFT-Driven Exploration: Creating NFT-driven exploration challenges that motivate players to discover hidden treasures or secrets can enhance engagement. NFT-Powered Puzzles: Incorporating NFT assets into puzzles or enigmas that require their use can stimulate player curiosity and problem-solving skills. NFT Trading Competitions: Organizing NFT trading competitions where players build valuable portfolios can foster engagement and strategic thinking. Dynamic NFT Events: Hosting dynamic NFT events that adapt to player actions or achievements can create an immersive and rewarding gaming experience. Localized NFT Lore Events: Creating NFT lore events tied to specific cultures or regions can resonate with players and encourage exploration. NFT-Enhanced Roleplaying: Using NFTs to enhance roleplaying experiences, such as unique character traits or abilities, can immerse players in their chosen roles. Real-Time NFT Events: Hosting real-time NFT events or auctions within the game world can create urgency and encourage immediate player participation. NFT-Gated Content: Introducing NFT-gated content or areas within the game can incentivize players to collect assets and engage with the game. NFT-Backed Social Challenges: Launching NFT-backed social challenges or trends can encourage community engagement and spark creative interactions. Interactive NFT Questlines: Designing questlines where players use specific NFT assets to unlock secrets or solve mysteries can engage curiosity. Time-Limited NFT Quests: Introducing time-limited NFT quests with unique rewards can generate urgency and motivate players to engage promptly. NFT-Driven Exploration Challenges: Launching NFT-driven exploration challenges that motivate players to uncover hidden treasures can stimulate engagement. Localized NFT Lore Events: Creating NFT lore events that cater to different player communities or regions can encourage exploration and engagement. NFT-Backed Puzzles: Designing intricate puzzles that require the use of NFT assets can engage players' critical thinking and problem-solving abilities. Emergent Competitive Strategies: NFTs can introduce emergent competitive strategies where players adapt their tactics based on evolving asset attributes. Localized NFT Economy: Creating localized NFT economies or marketplaces that reflect regional preferences can foster engagement within targeted communities. NFT-Infused Exploration: Using NFTs to unlock hidden or exclusive areas within the game can motivate players to explore and engage with the game world. Integrated NFT Rewards: Offering NFT rewards for completing in-game tasks can incentivize players to progress and engage with the game's mechanics. Player-Driven NFT Economy: Allowing players to create and sell NFT-based content, such as custom skins or mods, can foster engagement and entrepreneurship. Dynamic NFT Storytelling: Designing narrative arcs that dynamically evolve based on player interactions with NFT assets can create engaging storylines. Localized NFT Challenges: Launching NFT challenges tailored to specific player communities or cultural events can resonate and encourage engagement. NFT-Enhanced Role-play: Using NFTs to enhance roleplaying experiences, such as unique character traits or dialogue options, can immerse players further. Real-Time NFT Events: Hosting real-time NFT events or auctions that occur within the game environment can create excitement and encourage participation. Integrated NFT Collectibles: Incorporating NFT-based collectibles, such as character skins or emotes, can drive engagement and offer players customization options. Localized NFT Economy: Creating localized NFT economies or marketplaces can cater to player preferences and encourage engagement within specific regions. NFT-Infused Challenges: Designing challenges that require specific NFT assets to complete can encourage players to strategically use their collected items. Dynamic NFT Lore Expansion: Introducing NFT lore events or additions that expand the game's narrative can intrigue players and foster deeper engagement. Player-Generated NFT Content: Allowing players to create and trade NFT-based content, such as user-generated levels or items, can boost engagement. Localized NFT Quests: Designing localized NFT quests that reflect regional interests or traditions can resonate with players and stimulate engagement. NFT-Enhanced Exploration: Using NFTs to unlock hidden secrets or unique interactions within the game can motivate players to explore and engage. Emergent NFT Strategies: NFTs can introduce emergent competitive strategies where players adapt tactics based on evolving asset attributes. NFT-Backed Social Challenges: Organizing NFT-backed social challenges that encourage player interaction and creativity can enhance community engagement. Integrated NFT Cosmetics: Offering NFT cosmetics that players can customize and interact with can enhance the visual experience and drive engagement. Localized NFT Challenges: Launching NFT challenges tied to local events or cultural celebrations can resonate with players and encourage participation. Dynamic NFT Trading Mechanics: Implementing dynamic trading mechanics for NFT assets, such as live auctions, can enhance engagement and interaction. Collaborative NFT Quests: Designing quests that require players to collaborate using NFT assets can foster teamwork and encourage engagement. Time-Limited NFT Rewards: Introducing time-limited NFT rewards for achieving specific milestones can incentivize engagement and create excitement. Interactive NFT Auctions: Hosting interactive NFT auctions or bidding events can generate excitement, encourage participation, and create memorable experiences. Localized NFT Events: Designing NFT events that align with local festivities or cultural traditions can foster player engagement and inclusivity. NFT-Driven Puzzles: Incorporating NFT assets into in-game puzzles or enigmas can intrigue players and encourage exploration and problem-solving. Emergent NFT Storylines: NFTs can influence the branching paths and outcomes of the game's narrative, offering players dynamic storytelling experiences. NFT Social Competitions: Organizing social competitions or challenges where players showcase their NFT assets creatively can enhance community engagement. Integrated NFT Cosmetics: Offering NFT cosmetics that players can customize and interact with can enhance the visual experience and drive engagement. Localized NFT Challenges: Launching NFT challenges tied to local events or cultural celebrations can resonate with players and encourage participation. Dynamic NFT Trading Mechanics: Implementing dynamic trading mechanics for NFT assets, such as live auctions, can enhance engagement and interaction. Collaborative NFT Quests: Designing quests that require players to collaborate using NFT assets can foster teamwork and encourage engagement. Time-Limited NFT Rewards: Introducing time-limited NFT rewards for achieving specific milestones can incentivize engagement and create excitement. Interactive NFT Auctions: Hosting interactive NFT auctions or bidding events can generate excitement, encourage participation, and create memorable experiences. Localized NFT Events: Designing NFT events that align with local festivities or cultural traditions can foster player engagement and inclusivity. NFT-Driven Puzzles: Incorporating NFT assets into in-game puzzles or enigmas can intrigue players and encourage exploration and problem-solving. Emergent NFT Storylines: NFTs can influence the branching paths and outcomes of the game's narrative, offering players dynamic storytelling experiences. NFT Social Competitions: Organizing social competitions or challenges where players showcase their NFT assets creatively can enhance community engagement. Integrated NFT Cosmetics: Offering NFT cosmetics that players can customize and interact with can enhance the visual experience and drive engagement. Localized NFT Challenges: Launching NFT challenges tied to local events or cultural celebrations can resonate with players and encourage participation. Dynamic NFT Trading Mechanics: Implementing dynamic trading mechanics for NFT assets, such as live auctions, can enhance engagement and interaction. Collaborative NFT Quests: Designing quests that require players to collaborate using NFT assets can foster teamwork and encourage engagement. Time-Limited NFT Rewards: Introducing time-limited NFT rewards for achieving specific milestones can incentivize engagement and create excitement. Interactive NFT Auctions: Hosting interactive NFT auctions or bidding events can generate excitement, encourage participation, and create memorable experiences. Localized NFT Events: Designing NFT events that align with local festivities or cultural traditions can foster player engagement and inclusivity. NFT-Driven Puzzles: Incorporating NFT assets into in-game puzzles or enigmas can intrigue players and encourage exploration and problem-solving. Emergent NFT Storylines: NFTs can influence the branching paths and outcomes of the game's narrative, offering players dynamic storytelling experiences. NFT Social Competitions: Organizing social competitions or challenges where players showcase their NFT assets creatively can enhance community engagement. Localized NFT Challenges: Launching NFT challenges tied to local events or cultural celebrations can resonate with players and encourage participation. Dynamic NFT Trading Mechanics: Implementing dynamic trading mechanics for NFT assets, such as live auctions, can enhance engagement and interaction. Collaborative NFT Quests: Designing quests that require players to collaborate using NFT assets can foster teamwork and encourage engagement. Time-Limited NFT Rewards: Introducing time-limited NFT rewards for achieving specific milestones can incentivize engagement and create excitement. Interactive NFT Auctions: Hosting interactive NFT auctions or bidding events can generate excitement, encourage participation, and create memorable experiences. Localized NFT Events: Designing NFT events that align with local festivities or cultural traditions can foster player engagement and inclusivity. NFT-Driven Puzzles: Incorporating NFT assets into in-game puzzles or enigmas can intrigue players and encourage exploration and problem-solving. Emergent NFT Storylines: NFTs can influence the branching paths and outcomes of the game's narrative, offering players dynamic storytelling experiences. NFT Social Competitions: Organizing social competitions or challenges where players showcase their NFT assets creatively can enhance community engagement. Integrated NFT Cosmetics: Offering NFT cosmetics that players can customize and interact with can enhance the visual experience and drive engagement. Localized NFT Challenges: Launching NFT challenges tied to local events or cultural celebrations can resonate with players and encourage participation. Dynamic NFT Trading Mechanics: Implementing dynamic trading mechanics for NFT assets, such as live auctions, can enhance engagement and interaction. Collaborative NFT Quests: Designing quests that require players to collaborate using NFT assets can foster teamwork and encourage engagement. Time-Limited NFT Rewards: Introducing time-limited NFT rewards for achieving specific milestones can incentivize engagement and create excitement. Interactive NFT Auctions: Hosting interactive NFT auctions or bidding events can generate excitement, encourage participation, and create memorable experiences. Localized NFT Events: Designing NFT events that align with local festivities or cultural traditions can foster player engagement and inclusivity. NFT-Driven Puzzles: Incorporating NFT assets into in-game puzzles or enigmas can intrigue players and encourage exploration and problem-solving. Emergent NFT Storylines: NFTs can influence the branching paths and outcomes of the game's narrative, offering players dynamic storytelling experiences. NFT Social Competitions: Organizing social competitions or challenges where players showcase their NFT assets creatively can enhance community engagement. Localized NFT Challenges: Launching NFT challenges tied to local events or cultural celebrations can resonate with players and encourage participation. Dynamic NFT Trading Mechanics: Implementing dynamic trading mechanics for NFT assets, such as live auctions, can enhance engagement and interaction. Collaborative NFT Quests: Designing quests that require players to collaborate using NFT assets can foster teamwork and encourage engagement. Time-Limited NFT Rewards: Introducing time-limited NFT rewards for achieving specific milestones can incentivize engagement and create excitement. Interactive NFT Auctions: Hosting interactive NFT auctions or bidding events can generate excitement, encourage participation, and create memorable experiences. Localized NFT Events: Designing NFT events that align with local festivities or cultural traditions can foster player engagement and inclusivity. NFT-Driven Puzzles: Incorporating NFT assets into in-game puzzles or enigmas can intrigue players and encourage exploration and problem-solving. Emergent NFT Storylines: NFTs can influence the branching paths and outcomes of the game's narrative, offering players dynamic storytelling experiences. NFT Social Competitions: Organizing social competitions or challenges where players showcase their NFT assets creatively can enhance community engagement Localized NFT Challenges: Launching NFT challenges tied to local events or cultural celebrations can resonate with players and encourage participation. Dynamic NFT Trading Mechanics: Implementing dynamic trading mechanics for NFT assets, such as live auctions, can enhance engagement and interaction. Collaborative NFT Quests: Designing quests that require players to collaborate using NFT assets can foster teamwork and encourage engagement. Time-Limited NFT Rewards: Introducing time-limited NFT rewards for achieving specific milestones can incentivize engagement and create excitement. Interactive NFT Auctions: Hosting interactive NFT auctions or bidding events can generate excitement, encourage participation, and create memorable experiences. Localized NFT Events: Designing NFT events that align with local festivities or cultural traditions can foster player engagement and inclusivity. NFT-Driven Puzzles: Incorporating NFT assets into in-game puzzles or enigmas can intrigue players and encourage exploration and problem-solving. Emergent NFT Storylines: NFTs can influence the branching paths and outcomes of the game's narrative, offering players dynamic storytelling experiences. NFT Social Competitions: Organizing social competitions or challenges where players showcase their NFT assets creatively can enhance community engagement. Localized NFT Challenges: Launching NFT challenges tied to local events or cultural celebrations can resonate with players and encourage participation. Dynamic NFT Trading Mechanics: Implementing dynamic trading mechanics for NFT assets, such as live auctions, can enhance engagement and interaction. Collaborative NFT Quests: Designing quests that require players to collaborate using NFT assets can foster teamwork and encourage engagement. Time-Limited NFT Rewards: Introducing time-limited NFT rewards for achieving specific milestones can incentivize engagement and create excitement. Interactive NFT Auctions: Hosting interactive NFT auctions or bidding events can generate excitement, encourage participation, and create memorable experiences. Localized NFT Events: Designing NFT events that align with local festivities or cultural traditions can foster player engagement and inclusivity. NFT-Driven Puzzles: Incorporating NFT assets into in-game puzzles or enigmas can intrigue players and encourage exploration and problem-solving. Emergent NFT Storylines: NFTs can influence the branching paths and outcomes of the game's narrative, offering players dynamic storytelling experiences. NFT Social Competitions: Organizing social competitions or challenges where players showcase their NFT assets creatively can enhance community engagement. Localized NFT Challenges: Launching NFT challenges tied to local events or cultural celebrations can resonate with players and encourage participation. Dynamic NFT Trading Mechanics: Implementing dynamic trading mechanics for NFT assets, such as live auctions, can enhance engagement and interaction. Collaborative NFT Quests: Designing quests that require players to collaborate using NFT assets can foster teamwork and encourage engagement. Time-Limited NFT Rewards: Introducing time-limited NFT rewards for achieving specific milestones can incentivize engagement and create excitement. Interactive NFT Auctions: Hosting interactive NFT auctions or bidding events can generate excitement, encourage participation, and create memorable experiences. Localized NFT Events: Designing NFT events that align with local festivities or cultural traditions can foster player engagement and inclusivity. NFT-Driven Puzzles: Incorporating NFT assets into in-game puzzles or enigmas can intrigue players and encourage exploration and problem-solving. Emergent NFT Storylines: NFTs can influence the branching paths and outcomes of the game's narrative, offering players dynamic storytelling experiences. NFT Social Competitions: Organizing social competitions or challenges where players showcase their NFT assets creatively can enhance community engagement. Localized NFT Challenges: Launching NFT challenges tied to local events or cultural celebrations can resonate with players and encourage participation. Dynamic NFT Trading Mechanics: Implementing dynamic trading mechanics for NFT assets, such as live auctions, can enhance engagement and interaction. Collaborative NFT Quests: Designing quests that require players to collaborate using NFT assets can foster teamwork and encourage engagement. Time-Limited NFT Rewards: Introducing time-limited NFT rewards for achieving specific milestones can incentivize engagement and create excitement. Interactive NFT Auctions: Hosting interactive NFT auctions or bidding events can generate excitement, encourage participation, and create memorable experiences. Localized NFT Events: Designing NFT events that align with local festivities or cultural traditions can foster player engagement and inclusivity. NFT-Driven Puzzles: Incorporating NFT assets into in-game puzzles or enigmas can intrigue players and encourage exploration and problem-solving. Emergent NFT Storylines: NFTs can influence the branching paths and outcomes of the game's narrative, offering players dynamic storytelling experiences. NFT Social Competitions: Organizing social competitions or challenges where players showcase their NFT assets creatively can enhance community engagement. Localized NFT Challenges: Launching NFT challenges tied to local events or cultural celebrations can resonate with players and encourage participation. Dynamic NFT Trading Mechanics: Implementing dynamic trading mechanics for NFT assets, such as live auctions, can enhance engagement and interaction. Collaborative NFT Quests: Designing quests that require players to collaborate using NFT assets can foster teamwork and encourage engagement. Time-Limited NFT Rewards: Introducing time-limited NFT rewards for achieving specific milestones can incentivize engagement and create excitement. Interactive NFT Auctions: Hosting interactive NFT auctions or bidding events can generate excitement, encourage participation, and create memorable experiences. Localized NFT Events: Designing NFT events that align with local festivities or cultural traditions can foster player engagement and inclusivity. NFT-Driven Puzzles: Incorporating NFT assets into in-game puzzles or enigmas can intrigue players and encourage exploration and problem-solving. Emergent NFT Storylines: NFTs can influence the branching paths and outcomes of the game's narrative, offering players dynamic storytelling experiences. NFT Social Competitions: Organizing social competitions or challenges where players showcase their NFT assets creatively can enhance community engagement. Localized NFT Challenges: Launching NFT challenges tied to local events or cultural celebrations can resonate with players and encourage participation. Dynamic NFT Trading Mechanics: Implementing dynamic trading mechanics for NFT assets, such as live auctions, can enhance engagement and interaction. Collaborative NFT Quests: Designing quests that require players to collaborate using NFT assets can foster teamwork and encourage engagement. Time-Limited NFT Rewards: Introducing time-limited NFT rewards for achieving specific milestones can incentivize engagement and create excitement. Interactive NFT Auctions: Hosting interactive NFT auctions or bidding events can generate excitement, encourage participation, and create memorable experiences.NFTs are empowering the next generation of gaming by enabling true digital asset ownership and trading. Players crave opportunities to customize and invest in their gaming experience. By offering unique gaming NFT ideas that provide value, utility, and scarcity, game developers can drive engagement and revenue. However, launching compelling gaming NFTs requires extensive blockchain expertise. Partnering with an experienced NFT development company providing end-to-end NFT marketplace development services is key. With the right gaming NFT strategy, developers can dramatically enhance player enjoyment and loyalty. Contact a top NFT development services provider like RWaltz today to bring your gaming NFT ideas to life.If you are willing to develop the Gaming NFT Marketplace, then RWaltz is here to guide you for end-to-end platform development. RWaltz has good experience in NFT Marketplace Development Services. Feel free to reach out for an on-the-house consultation.

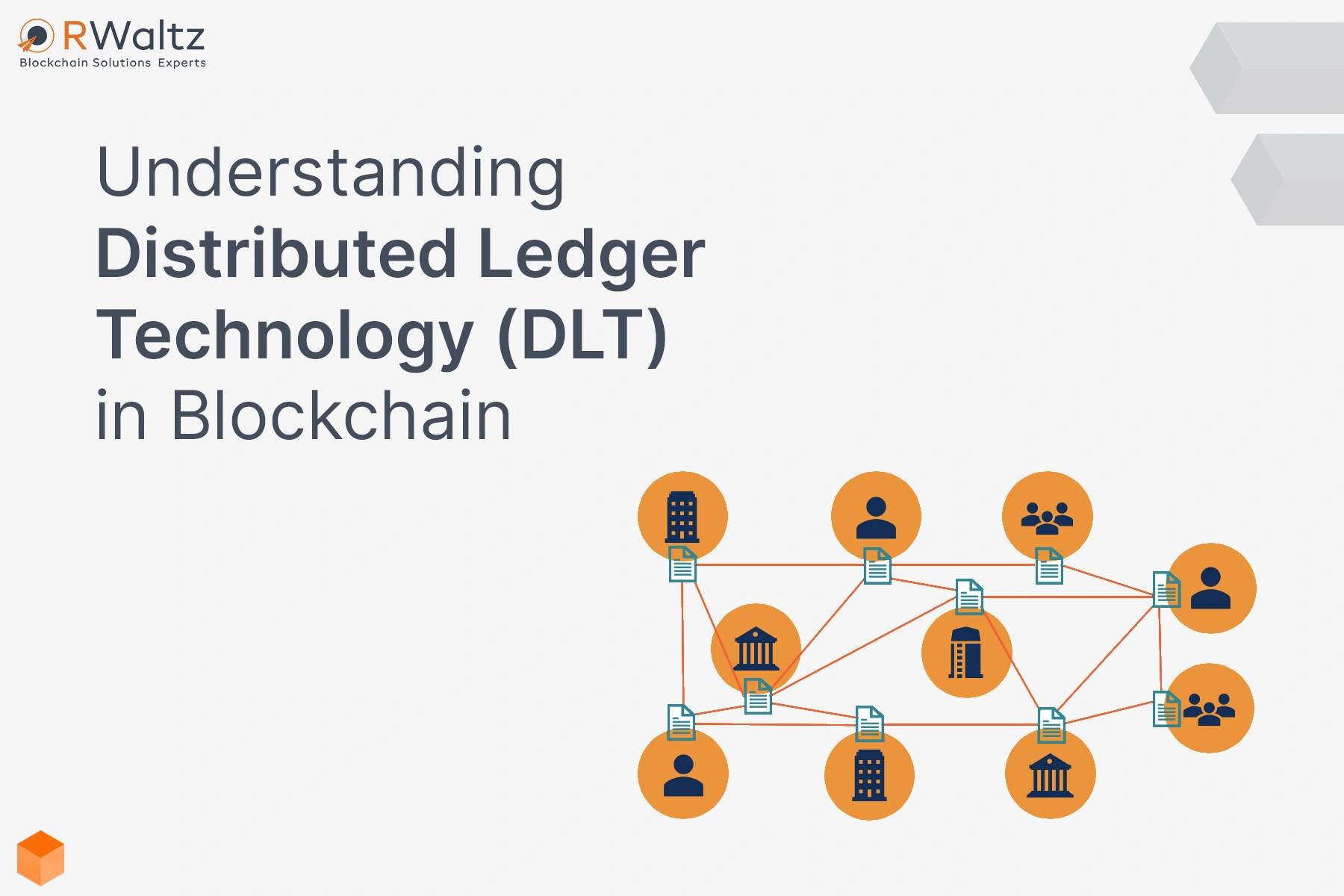

Understanding Distributed Ledger Technology (DLT) in Blockchain

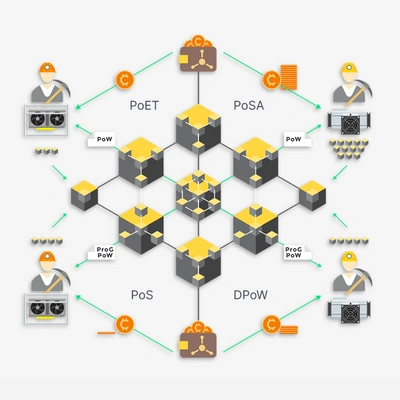

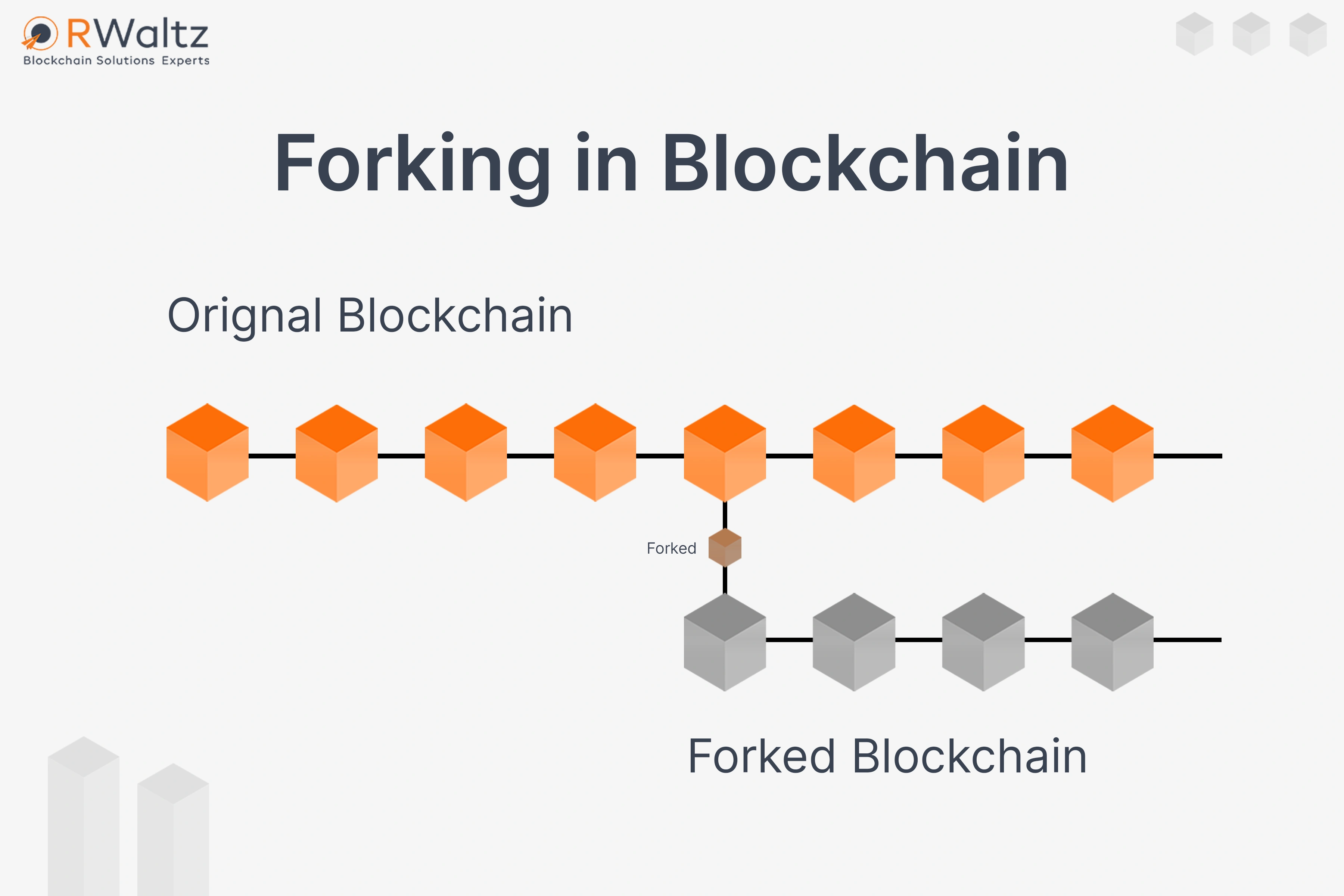

Distributed ledger technology (DLT) is a key component of blockchain and serves as the foundation for recording transactions and data on a decentralized network. DLT allows multiple participants to securely access, verify and update a shared ledger of transactions without the need for a central authority. Let's take a deeper look at how DLT works and its role in enabling blockchain innovations.What is a Distributed Ledger?A distributed ledger is a database that is consensually shared and synchronized across multiple sites, institutions or geographies. It allows transactions to have multiple identical copies maintained on multiple computer nodes in a network. Any changes or additions made to the ledger are reflected and copied to all participants in real-time.Unlike traditional centralized ledgers which rely on a central administrator, distributed ledgers have no central point of data storage or administration. The ledger records are stored in a decentralized manner across the network, eliminating single points of failure. This enhances security, transparency and trust in record keeping.Key Properties of Distributed Ledger TechnologyDecentralization: The ledger is distributed among participants without needing centralized control. This eliminates intermediaries, reduces costs and enhances reliability.Consensus: Changes to the ledger are validated through a consensus mechanism agreed upon by the network participants. This maintains integrity of the shared ledger.Provenance: The ledger provides a chain of custody for transactions, enabling participants to trace the origin and ownership history of assets.Immutability: Once data is recorded on the shared ledger, it cannot be altered retroactively. This creates permanent and tamper-proof records.Finality: Approved transactions are final when consensus is reached and cannot be reversed. This provides transaction certainty.Cryptography: Cryptographic techniques like digital signatures, hashing and Merkle trees secure the ledger contents and validate transactions.Types of Distributed Ledger TechnologyThere are mainly three types of distributed ledger technology: Blockchain: This is the most common form of distributed ledger technology. Transactions are recorded in consecutive blocks which are chained together chronologically to create permanent and immutable records. It enables peer-to-peer transfer of value without intermediaries. Bitcoin is the most well-known application of blockchain. Directed Acyclic Graph (DAG): This uses a DAG data structure to record transactions across multiple channels simultaneously. Unlike blockchain's sequential structure, DAG enables faster transactions and no transaction fees. IOTA and Nano are examples of DAG-based DLT. Hashgraph: This uses a patented gossip protocol that allows nodes in a network to efficiently share transactions via gossip. It offers faster consensus and throughput compared to blockchains. Hedera Hashgraph is a leading hashgraph-based distributed ledger.How Distributed Ledger Technology WorksThe key steps involved in a distributed ledger network include: Initialization: The participating nodes begin by establishing a peer-to-peer network, rules of participation, consensus mechanism, cryptography standards, governance protocols etc. Transaction request: A node requests a transaction like transfer of assets which is digitally signed and broadcast to the network. Validation: Network nodes validate the transaction according to predefined rules. Invalid transactions are rejected. Consensus: The valid transaction is added to a new block or entry which is shared across nodes to confirm its validity via a consensus mechanism. Recording: Once consensus is reached, the approved transaction is timestamped and irreversibly recorded in the shared ledger. Finality: The transaction is complete, altering the states of the participating accounts or assets permanently. Reconciliation: All copies of the ledger are updated and reconciled in real-time across the distributed network.Consensus Models in Distributed Ledger TechnologyConsensus refers to the process by which participants in a distributed ledger agree to validate transactions and record new data. Some common consensus mechanisms include: Proof-of-work - Participants prove through computational work that they have invested resources to validate transactions. Used in Bitcoin. Proof-of-stake - Selects validators based on the stake they hold in the network's assets to validate transactions. Used in Ethereum. Practical Byzantine Fault Tolerance (PBFT) - Enables nodes to reach consensus via voting by exchanging messages between nodes. Used in Hyperledger. Proof-of-Authority - Uses approved validators chosen based on reputation to validate transactions and blocks. Used in private blockchains. Directed Acyclic Graph (DAG) - Enables asynchronous and parallel transaction validation across multiple nodes with no central coordinator. Used in IOTA, Nano.Benefits of Distributed Ledger TechnologyDecentralization - Eliminates central points of failure and the need for intermediaries.Trust - Enhanced security, transparency, and audibility build trust.Efficiency - Faster, low-cost transactions and settlements compared to traditional systems.Reliability - Distributed nature increases resilience against outages or manipulation.Provenance - Maintains immutable history of asset ownership and transactions.Automation - Smart contracts enable complex business rules and workflows to be automated.Tokenization - Assets like contracts or property can be represented as digital tokens.Immutable Records - Information recorded on the shared ledger cannot be altered, deleted, or lost.Use Cases of Distributed Ledger TechnologyFinancial systems - Payments, asset transfers, capital markets, trade finance.Supply chains - Tracking goods movement, certifications, and provenance.Healthcare - Electronic health records, benefits processing, clinical trials.Government - Land registries, identity management, voting systems.Energy - Trading carbon credits, renewable energy certificates (RECs).Media - Digital content ownership and distribution, intellectual property.Real estate - Property transactions, title transfers, landlord-tenant agreements.Legal - Contracts, patents, wills, company registrations.Insurance - Claims processing, know your customer (KYC) processes.Challenges with Distributed Ledger Technology Scalability - Current limits in transaction processing and data storage need to be overcome. Interoperability - Cross-chain interaction and standards need further development. Compliance - Aligning DLT solutions with regulations remains a challenge. Usability - User experience and interfaces need improvement for mass adoption. Energy Use - Proof-of-work consensus is energy intensive. Alternatives need growth. Security - Ensuring resilience to attacks like 51% attacks remains vital. Privacy - Providing user anonymity while meeting compliance needs further work.The Future of Distributed Ledger TechnologyDLT is rapidly evolving with extensive investments in research and development. Areas of expected growth include: Enterprise adoption of distributed ledgers for streamlining business processes and data sharing. Integration of DLT, IoT, AI and machine learning to create intelligent decentralized networks. Cross-chain interoperability and atomic swaps enabling seamless transactions across ledgers. Development of decentralized data storage and cloud solutions to store massive amounts of data. Evolution of consensus protocols and governance models for public distributed ledgers. User-controlled digital identities underpinned by DLT will expand participation. Tokenization of assets like real estate, commodities, intellectual property will increase liquidity. Faster transaction speeds, scalability and energy efficiency will enhance usability. Use of directed acyclic graphs and hashgraphs as high performance alternatives to blockchain. Growth of decentralized finance built on open distributed ledgers.ConclusionDistributed ledger technology provides a revolutionary decentralized approach to record-keeping and transactions compared to traditional centralized accounting systems. By eliminating intermediaries and counterparty risks, DLT enables peer-to-peer transfer of value and facilitates collaboration at unprecedented scale. As blockchain, DAGs, hashgraphs and related innovations continue maturing, DLT promises to transform enterprise systems and business models across industries and reinvent economic coordination.As a leading blockchain development company, RWaltz specializes in leveraging distributed ledger technology to build customized decentralized solutions for clients globally. Connect with our experts to assess how DLT can transform your business!

Algorithms in AMM for DEX Development

Decentralized exchanges (DEXs) have become an integral part of the cryptocurrency ecosystem, providing a means of trustless trading without centralized intermediaries. A core component enabling decentralized trading on DEXs is the automated market maker (AMM). AMM algorithms help provide continuous liquidity and price discovery on DEX platforms.In this article, we'll explore key AMM algorithms and how they facilitate decentralized cryptocurrency trading.What is an Automated Market Maker?An automated market maker (AMM) system provides liquidity to a decentralized exchange using a mathematical formula. Unlike traditional order book exchanges, AMMs don't require buyers and sellers to place orders. Instead, liquidity pools are created programmatically.The AMM uses an algorithm to determine asset prices based on the liquidity pool's supply and demand for tokens. This algorithm replaces the order-matching function performed by centralized exchanges.Key Benefits of AMMs: Always provide liquidity, even for low-volume assets No order matching needed Fairer prices determined algorithmically Increased decentralization through trustless tradingPopular AMM AlgorithmsThere are several AMM algorithms, each with its own unique mechanisms for facilitating trading. Let's explore some of the most widely used.Constant Product Market MakerThe constant product market maker (CPMM) is the most common AMM algorithm, used by leading DEXs like Uniswap. It works by maintaining a constant product between the quantities of token pairs in a liquidity pool:x * y = kWhere x and y represent the quantities of tokens X and Y in the pool, and k is a constant.Whenever a trade occurs, the product is maintained by adding or removing liquidity from the pool. This adjusts the relative token prices automatically based on supply and demand.CPMM Benefits: Simple and efficient algorithm Fair token prices based on ratios No external data needed to set pricesCPMM Drawbacks: Prices can fluctuate with large trades Impermanent loss for liquidity providers Overall, CPMM offers a straightforward way to facilitate AMM trading, making it a popular choice despite some drawbacks. Invariant Market MakerThe invariant market maker (IMM) aims to improve on CPMM by using a different formula to determine prices:x * y = k / (x + y)Rather than a simple product, it divides the product by the sum of x and y token amounts. This helps mitigate some issues like price volatility and impermanent loss.IMM Benefits: More stable prices Lower impermanent loss Resilient against manipulationIMM Drawbacks: Added complexity Reduced liquidity for large trades For developers looking for an AMM with stronger guarantees, IMM offers a more robust algorithm than CPMM. Kyber Network's Constant Function Market MakerKyber Network proposes an alternative AMM model called the Constant Function Market Maker (CFMM). It determines prices using the following formula:x * y = k * f(x, y)The function f(x, y) incorporates additional factors beyond just the ratio between token amounts x and y. It takes into account the trading volume and ratios between reserves to improve the market making algorithm.CFMM Benefits: More efficient prices Considers multiple liquidity sources Dynamic based on real-time dataCFMM Drawbacks: Requires oracles for price data Higher gas fees due to complexity For developers wanting a data-aware solution, CFMM leverages external information to optimize the AMM algorithm. Uniswap V3's Flexible AMMUniswap V3 introduces a flexible AMM model (FMM) with customizable liquidity ranges. Liquidity providers can set price ranges for adding funds to a pool. This allows concentrating liquidity at desired prices.The FMM formula uses the midpoint price x to determine the pool price y:y = x + s * (x - x)Where s is a parameter between 0 and 1 for the price range. This formula enables adjustable liquidity allocation.FMM Benefits: Customizable liquidity ranges Improved capital efficiency Higher yield potentialFMM Drawbacks: Added complexity for LPs Fragmented liquidity For developers wanting more configurability for liquidity provisioning, FMM adds advanced parameters.Evaluating AMM SolutionsWhen evaluating AMM solutions, here are some key considerations: Required capital efficiency Ability to handle trading volumes Price stability needs Integration complexity Customizability needsDevelopers should assess their specific exchange requirements to determine the optimal algorithm. A combination of multiple AMMs can also be leveraged.Building a Custom AMMFor teams wanting maximum control and customization, building a proprietary AMM algorithm is an option. This allows creating an AMM tailored to your exchange model and tokenomics.Key aspects of a custom AMM include: Formulating pricing equations and ratios Programming liquidity pool interactions Developing oracles for external data Programming incentive mechanisms Configuring exchange parameters and interfacesWhile complex, a custom AMM unlocks capabilities aligned with your DEX's needs.ConclusionAMM algorithms are critical for enabling decentralized trading on cryptocurrency exchanges. Teams have a variety of options to evaluate from established CPMM and IMM models to more advanced CFMM and FMM algorithms.For people looking to develop out a new decentralized exchange protocol, AMM technology is a crucial component. Assessing your requirements and exploring different AMM solutions will allow creating an automated market maker optimized for your platform's needs. Reach out if you need any guidance building a custom algorithm or implementing an AMM for your DEX architecture.

The Effects of PayPal's Stablecoin on Global Banking

PayPal's new stablecoin PYUSD is a big deal for global banking. As the first stablecoin from a major financial company, it could really shake things up.Sending Money Overseas:International money transfers are one area in which PYUSD could be a game-changer. Due to bank fees and regulations, sending money abroad can be tedious and expensive. Without all the typical banking middlemen, PYUSD has the potential to facilitate quick and inexpensive international transfers.Micropayments:PYUSD has enormous potential for micropayments. These are little transactions, such as those for online subscriptions or content. Currently, bank transfers and credit cards aren't the most micropayment-friendly options. PYUSD might give users and businesses additional possibilities.Lower Fees: PYUSD is a threat to the domination of big banks over payments, beyond money transfers and micropayments. PayPal's entry into stablecoins as a significant payments processor could offer it an advantage over conventional banks. PayPal may increase the number of people using its payment facilities by offering reduced prices and simpler options.PYUSD shows how global banking is evolving. Stablecoins are catching on because they have advantages over old payment methods. For banks to stay competitive, they'll have to adapt to these changes.Here are some of the ways PYUSD could transform banking:More competition - PYUSD brings healthy competition for cross-border and micropayments. This could lower costs and improve services.Financial innovation - Stablecoins enable new financial products like lending platforms and investment funds. This innovation can make finance more dynamic and efficient.Mainstreaming crypto - PYUSD could bridge the gap between the average user and cryptocurrencies. This may boost demand for Bitcoin, Ethereum, etc.Regulatory changes - PYUSD may lead regulators to update their approach to crypto regulation, like implementing stricter rules.In short, PayPal's stablecoin launch is a big step that could reshape banking. Banks need to keep up with the crypto evolution to stay relevant.If you wish to create your own stablecoin then RWaltz is the best company as a solution partner for Token Development Services.Feel free to book a free consultation for your project.

What are the benefits of Crypto Staking?