Token Development Services

Leverage the Cutting-edge Blockchain Platforms to Avail Brand Recognition Through Our Token Development Services

Features of Token Development Services

Multiple Token Standards

Expertise in BEP20, TRC20, ERC20 token development, our solutions experts develop tokens meeting the popular token standards.

Tailored Smart Contract

RWaltz, being one of the leading Token Development Companies, tokenizes the financial assets, where the Smart Contracts are tailored based on the requirements of the digital assets. These self-executing contracts represent the agreement between the buyer and seller making the transactions traceable, irreversible and transparent.

Quality Assessment

With enhanced security protocols and flawless Token Development Services, RWaltz follows rigorous testing and quality assessment methodologies delivering quality assurance to our clients.

Token Listing Assistance

The Token Development Services offer exposure to your tokens in the Crypto market, where the tokens are listed based on market cap and current market volume for efficient trading of assets.

Verifiable

At RWaltz, we create tokens that can verify the data of ownership directly, reducing the need for a surplus authentication process.

Reliable

RWaltz being the leading Token development Company, we aim to deliver reliable Token development services to our esteemed clients. With our token development services, we enable our clients to raise capital from across the world.

Why RWaltz for Token Development Services?

RWaltz being the leading Token development Company, we aim to deliver reliable Token development services to our esteemed clients. With our token development services, we enable our clients to raise capital from across the world.

Expert Team

At RWaltz, we have certified and experienced professionals, who upgrade their technology expertise regularly to ensure customer satisfaction.

Investment Opportunity

Through our Token Development Services, we enable our customers to raise capital from across the world.

Round the Clock Services

Our experts are available 24x7x365 to resolve the queries fired by our clients ensuring seamless token development services.

Token Development Process

Decide! Design! Develop!

- 1.Ideate your Project Structure

- 2.Choose a suitable crypto token development company

- 3.Select a Blockchain Platform

- 4.Integrate the smart contract with Token Development Services

- 5.Choose the Token Type

- 6.Add the Transferable Attributes

- 7.Set up Token Identity

- 8.Define the Date of Token Launch

- 9.Website Design and development

Frequently Asked Questions

Avail In-depth Knowledge on NFTs and NFT Marketplace Here!

What is a Token?

A token is a digital asset that is used for trading either physical or virtual assets. Depicting a set of rules in a smart contract, each token is owned by a specific Blockchain address. The Token Development Services offer Crypto Tokens that facilitate collaboration across markets and jurisdictions enabling transparent, efficient, and fair interactions in the physical, virtual, and legal world.

What is Tokenization?

The Token Development Services comprise of converting the confidential data into nonsensitive data termed “Tokens”, which is used by the internal system without revealing the actual information is called Tokenization. With no mathematical relationship between the tokens and the original information, the tokenized data is irreversible.

What is the difference between Cryptocurrency and a Token?

Before availing the Token Development Services, it is important to understand the difference between Cryptocurrency and a Token.

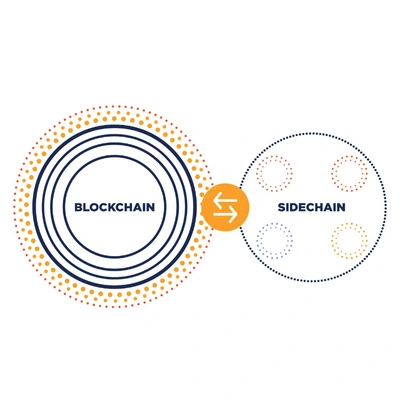

The thin line of differentiation between Cryptocurrencies and Tokens is cryptocurrencies are built on their own Blockchain Network while tokens are digital assets that are developed on an existing Blockchain Network.

Cryptocurrency depicts the newest form of digital money whereas the tokens are used to represent a digital asset or a utility.

How do Tokens Work in Blockchain?

Depicting the set of rules, encoded in a smart contract, the tokens are accessible with a dedicated digital wallet that manages the public-private key pair for a specific Blockchain address. The user with the private key to the blockchain address is only allowed to access the respective token. The user signs the private key to initiate the trading of tokens, thereby creating a digital signature of the owner of the token. The token development companies offer efficient token development services for secure trading.

What are the types of Tokens?

- Utility Tokens: Depicting the characteristics of a classic cryptocurrency like Bitcoin, these tokens offered by Token Development Companies help to capitalize or finance projects for startups, companies, or project development groups.

- Security Tokens: Acting as a digital stock certificate, the security tokens are the digital or liquid contracts that preserve the ownership right for a particular digital asset like real estate, a car, or corporate stock on a Blockchain ledger.

- Currency Token: Referred to as Classic Cryptocurrency like Bitcoin, these tokens created by Token Development Companies can be spent on a variety of daily transactions in the real world offering the best alternative to fiat currency.

- Reward Token: Designed to become more scarce over a period, the Reward token is initially conceived as a way to offer rewards to people using a particular platform’s cryptocurrency.

Asset Token: The asset-backed tokens depict the digital claims on the physical assets reducing the need to head out in the traditional market to buy a share of the real-world asset.

News

Read our recent blogs

Solutions, stories and thought leadership from across the company

Mastercard Makes Music with NFTs

Legacy financial services giant Mastercard recently announced an exciting new NFT project that aims to support emerging musicians worldwide. The company is launching a collection of NFTs called "Priceless" that will grant holders access to exclusive music experiences, mentoring, marketing promotion and more through Mastercard's existing "Priceless" loyalty program.This NFT collection marks a major milestone for Mastercard's crypto and web3 efforts. It shows how traditional finance and big tech are increasingly embracing NFTs and blockchain technology for new use cases like memberships, loyalty programs, and community engagement.About Mastercard's Priceless NFT CollectionMastercard revealed it will drop the "Priceless" NFT collection on the Ethereum blockchain in April 2023. The NFTs will feature exclusive artwork from 10 up-and-coming musicians around the world.There will be three tiers of NFTs based on different levels of access, rewards, and exclusivity for holders: Emerging Artist NFT - Basic tier for early supporters Rising Artist NFT - Mid-level with more rewards Established Artist NFT - Top-tier with the highest level of exclusive perksBenefits for NFT holders include personal mentoring from industry leaders, marketing and social promotion of their music, and passes to Mastercard branded events like Priceless concerts and experiences.This approach lets fans directly support artists they believe in early on. It also lets Mastercard tap into crypto culture and allows musicians to build engaged communities of NFT-holding fans.Why NFTs Make Sense for MastercardFor Mastercard, NFTs present a logical extension of its long-running Priceless loyalty program. The credit card company has leveraged Priceless for years to make cardholders feel special and provide unique experiences like exclusive dining events and early concert access.With NFTs, Mastercard can evolve this program to be crypto-native. Loyalty points and membership perks can be directly integrated with blockchain tech. This lets Mastercard innovate around digital ownership and scarcity while connecting with younger, crypto-savvy audiences.More broadly, NFTs and crypto align with Mastercard's increasing focus on web3, the metaverse, and emerging technologies. The company clearly recognizes blockchain's potential to transform payments, banking, and commerce.The Priceless NFT collection will provide Mastercard with insights into crypto users' behaviors and demands. It will inform how the payments giant can provide value to consumers and merchants across both traditional finance and decentralized ecosystems.The Future of NFTsMastercard is joining a growing list of major brands experimenting with NFTs. From Nike to McDonald's, we're seeing household names launch everything from branded collectible NFTs to virtual experiences and metaverse activations.This surge in interest makes it clear that NFT applications are expanding beyond profile pic collections and digital art. There is tremendous potential for tokens, membership passes, fan engagement tools, and more.For companies and creators looking to develop NFT projects, partnering with an expert token development firm like RWaltz can help bring concepts to market. With blockchain development and smart contract audit services, they enable brands to launch NFTs safely and successfully.As Mastercard's new Priceless NFT collection demonstrates, we're only beginning to see how NFTs can transform loyalty programs, access passes, communities, and countless other use cases across industries.

Best Time to Launch a Crypto Token: 2024

Timing can be everything for blockchain projects and startups considering launching a crypto token. Overall market conditions and sentiment heavily influence the trajectory of new tokens. While predicting price movements is notoriously difficult, certain years tend to present more favorable windows based on the maturation of the market and key events. For teams ready to take their project live, 2024 is shaping up to be an optimal year. leveraging seasoned crypto token development services can set the stage for exponential growth.Why Launch a Token?Before exploring market timing, it helps to consider the key reasons projects may create native crypto tokens in the first place: Funding - Many projects kickstart with a token sale, allowing bootstrap fundraising from the community. This is especially popular for open-source protocols. Incentives - Tokens allow incentivizing behaviors that grow the network like node operation, platform activity, governance participation, etc. Exchange - Native tokens allow value exchange within ecosystem services like DeFi lending, NFT marketplaces, computational networks, gaming worlds, etc. Ownership - Tokens can represent fractional ownership in underlying assets like real estate, renewable energy, or digital goods. Governance - Token holders often gain voting rights within decentralized autonomous organizations and protocols.A well-designed token aligns incentives between the project, community of users/investors, and other stakeholders. By leveraging crypto economics, applications can develop into decentralized networks.Current Market ConditionsTo determine the optimal timing for a token launch, projects must analyze evolving blockchain conditions: Maturing Infrastructure - Robust middleware, developer tools, computational capacity, data feeds, etc. now exist for launching robust token models. Mainstream Adoption - Cryptocurrency awareness among the general public continues rising after recent rallies and institutional investment. Regulatory Clarity - Watchdogs worldwide are gradually providing more guidance around compliant crypto projects, reducing uncertainty. Investor Appetite - After periods of euphoria and despair, markets appear to be entering a more mature accumulation phase seeking fundamentally sound projects. Improving Sentiment - Following the last "crypto winter" and shakeout of overhyped projects, optimism is steadily returning around well-executed teams.These dynamics indicate prime conditions are forming to launch blockchain ventures built on meaningful real-world utility. The stage is set for sustainable growth.Why 2024 Looks OptimalWhile market timing is difficult, 2024 looks especially ripe for new crypto ventures based on several key factors:Bitcoin HalvingThe periodic halving of Bitcoin's block reward has consistently been an enormously bullish catalyst. With the next halving expected in 2024, history suggests a strong tailwind for crypto.Ethereum UpgradesEthereum has major architecture improvements planned to launch around 2024 like proof-of-stake migration and sharding. This will greatly expand capacity, use cases, and enthusiasm for Ethereum-based tokens.Regulatory ClarityOngoing guidance from regulators like the SEC will reduce uncertainties around compliant token projects, and many issues will be settled by 2024.Market Cycle RecoveryFollowing sharp selloffs in 2022, markets will have likely bottomed and regained an appetite for promising crypto projects by 2024.Mainstream MomentumWith crypto going mainstream, 2024 could see the velocity of public participation and investment capital hitting an inflection point.Maturing InfrastructureBy 2024, the middleware, tooling, documentation, cloud services, and other infrastructure underpinning blockchain projects will have greatly matured.The confluence of these catalysts makes 2024 an ideal launch point for blockchain ventures to ride several synergistic tailwinds. However, seizing the opportunity still requires impeccable execution.Best Practices for Launching in 2024To fully capitalize on favorable market conditions requires meticulous preparation:Robust Token Economic ModelingProjects must undertake rigorous simulations and scenario modeling to engineer a token correctly calibrated for their network incentives and behaviors.Institutional-Grade SecurityInstitutional investors and regulators demand best practices around auditing, formal verification, controls, and governance for crypto projects.Compliance by DesignA proactive compliance-by-design approach is essential to navigate securities regulations and launch legally. Know Your Customer (KYC) and Anti Money Laundering (AML) controls will be mandatory.Mainstream BrandingAs crypto goes mainstream, branding, positioning, partnerships, and PR must appeal to a more professional investor audience.Enterprise-Grade TechnologySystem design, architecture, integrations, middleware, DevOps, and redundancy should meet enterprise standards. Battle-testing is critical.By combining these elements, blockchain projects launching token models in 2024 can expect to ride multiple tailwinds to exponential growth built on real-world utility.Partnering With Experienced TeamsPulling off a professionally executed token launch amidst complex, fast-moving crypto markets is extremely challenging. This is why most successful projects partner with experienced blockchain development teams.Working with seasoned crypto-native service partners provides crucial advantages:Proven Track Record - The team has taken multiple previous token projects to live through bull runs and bear markets. Their expertise averts costly pitfalls.Technical Resources - The team possesses extensive in-house resources across token economics, smart contract programming, security auditing, infrastructure engineering, and compliance processes.Industry Connections - The team's network provides connections to crypto-savvy user bases, investors, influencers, exchanges, media, and other partners to accelerate traction.Guidance and Support - The team provides hands-on guidance before, during, and after launch to ensure smooth execution. Their insight is invaluable.By leveraging an experienced token development partner, blockchain projects can focus on their core competencies and community rather than technical complexities. This hugely de-risks executing a successful market debut.For blockchain projects, timing a token launch well is critical - but so is impeccable execution. The expected market conditions and catalysts coalescing in 2024 present a prime opportunity. But seizing it requires extensive diligence and capabilities. By combining favorable timing with an institutional-grade approach and experienced partners, projects launching crypto tokens in 2024 are primed for exponential growth trajectories. The window for breakout potential is open.Planning a crypto token launch? The experts at RWaltz have taken dozens of blockchain projects to market successfully - including through previous bull and bear cycles. Get in touch today to learn how we can execute a professionally managed token launch built for institutional investors in 2024. Let's plan your breakthrough.Let me know if you would like me to modify or expand on any part of this draft blog article. I'm happy to refine the content further to create an informative, engaging piece on 2024 being an optimal period for launching crypto tokens. Please feel free to provide any feedback!Crypto token development involves deep expertise across crypto economics, smart contract programming, security auditing, regulatory compliance, liquidity provision, and effective launch execution. By partnering with a proven token development services firm with experience across bull and bear markets, blockchain projects can focus on their competitive edge while experts handle navigating optimal timing and the underlying token complexities.

An Introduction to Tokens and Why They Matter

Blockchain technology and cryptocurrencies are transforming finance and business. But for many who are new to this space, the sheer amount of unfamiliar terms like "blockchain", "cryptocurrency", "token", etc. can be overwhelming.In this post, we'll break down blockchain tokens in simple terms - what they are, why they matter, real-world examples, and more.What is a Token?A token represents an asset or utility on a blockchain network. It is a digital representation of value that is recorded on a distributed ledger.Some key properties of tokens: Digital: Tokens only exist in digital form, not physical. You can't touch or see a token. Programmable: Tokens are programmed using smart contracts, which are code that automatically executes actions on a blockchain. Transferable: Tokens can be easily transferred from one holder to another. Verifiable: The blockchain ledger provides transparency over who owns which tokens. Divisible: A token can be divided into smaller units, enabling micropayments. Fungible: Tokens of the same type and value can be substituted for one another.Types of TokensThere are many kinds of tokens with different purposes. Some major token types: Cryptocurrencies: Tokens like Bitcoin and Ethereum's Ether are used as a means of payment and exchange like digital cash. Utility tokens: These tokens give holders access to a product or service on the blockchain. For example, Filecoin tokens allow users to pay for decentralized cloud storage. Security tokens: These are blockchain-based assets that represent traditional securities like company shares, bonds, derivatives, etc. Non-fungible tokens (NFTs): NFTs are unique collectible tokens that represent ownership of digital or physical assets like art, music, games, etc.Why Do Tokens Matter?Tokens enable new business models and financial innovations: Decentralized Finance: Cryptocurrency tokens allow peer-to-peer finance apps like lending and trading without traditional intermediaries. Fan Engagement: Sports teams and music artists are issuing NFTs to connect with fans. Global Payments: Cross-border blockchain payments are faster and cheaper using tokens. Tokenized Assets: Real-world assets like real estate can be fractionalized into security tokens for wider investment access. Company Shares: Instead of IPOs, tokens enable companies to raise funds via token sales. Loyalty Programs: Brands can issue utility tokens to reward customers for engagement. Digital Collectibles: NFTs make collecting unique digital items possible, leading to new gaming economies.And this is just the beginning. tokens are enabling the digitization and tokenization of many more aspects of business, finance, and society.Real-World Token ExamplesTo understand the versatility of tokens, let's look at some real-world examples across different industries:1. Ethereum (ETH)Ethereum's Ether token (ETH) is the second most valuable cryptocurrency after Bitcoin. ETH is the "fuel" that powers the Ethereum network - it is required to execute smart contracts and launch new Ethereum apps called dApps. Major DeFi apps for borrowing, lending, trading, insurance rely on ETH for transactions.2. Chainlink (LINK)Chainlink created the LINK token to reward data providers who supply external data to blockchain applications. LINK is used to pay node operators who validate this data to ensure accuracy. Decentralized finance apps use Chainlink to securely connect with real-world data.3. Axie Infinity (AXS)The AXS token powers the popular blockchain-based game Axie Infinity. AXS holders can earn rewards and influence decisions for the game via governance rights. Players need AXS tokens to trade the cute digital pets called Axies - a unique NFT-based gaming model.4. Sandbox (SAND)The Sandbox metaverse platform uses SAND tokens for virtual real estate transactions and in-game purchases. Brands like Gucci have bought virtual land in The Sandbox metaverse using SAND tokens, recognizing the value of blockchain virtual worlds.5. Theta (THETA)Theta token powers the decentralized video streaming network Theta Network, allowing users to share bandwidth and computing resources. Theta aims to provide high-quality streaming while reducing costs by up to 80% compared to conventional CDN platforms through token rewards.6. Citi Token ServiceRecently, Citi announced its Citi Token Service built on a permissioned Ethereum blockchain. It offers crypto-enabled cross-border payments, escrows, and trade finance to institutional clients. The service uses deposit tokens fully redeemable for fiat currency to reduce friction in global transactions and trade.This demonstrates the interest of major banks like Citi to adopt tokenized solutions for improving financial services. We can expect wider exploration of crypto-tokens by traditional finance going forward.Let's examine the details of Citi's tokenized service and its wider implications.Overview of Citi Token ServiceCiti Token Service is built on an Ethereum-based private permissioned blockchain. The distributed ledger technology allows real-time movement of tokenized funds globally between Citi branches and clients.The service digitizes traditional banking assets and liabilities into verifiable blockchain tokens. These represent fiat currency at a 1:1 ratio, like 1 token = $1. Citi calls them 'deposit tokens' or 'DTBs'.By enabling round-the-clock transfer and redemption of DTBs for fiat, the service addresses latency issues caused by time zone gaps between countries. Settlement times are reduced from days to minutes.Citi already conducted successful pilots with clients like Maersk and a canal authority using smart contracts that automate payments upon fulfillment of contractual conditions.Key Capabilities OfferedCiti Token Service will facilitate:Atomic cross-border transfers: Instant around-the-clock global funds movement becomes possible between Citi affiliates and clients on a shared ledger. This overcomes latency issues due to time zone differences.Liquidity management: Pooled accounts across Citibranches are tokenized for real-time intraday liquidity monitoring and movement. Clients can transfer liquidity between accounts 24/7.Trade finance automation: Payments can be triggered automatically upon contract fulfillment based on data feeds. This is done using smart contracts instead of letters of credit.Settlement with central bank money: Direct integration with Central Bank Digital Currencies (CBDCs) when available will allow atomic settlement.Regulatory compliance: Citi's banking licenses across 90+ countries ensure regulatory compliance. The private nature of the network also aids compliance.Proven technology: Built using the enterprise Ethereum blockchain network backed by Microsoft, JP Morgan and others. Integration is easier for institutions familiar with Ethereum.Why Global Finance's Significance Cannot Be OverlookedCiti bringing crypto-tokens into the mainstream banking playbook represents a watershed moment for institutional blockchain adoption. Here are some reasons it matters: Faster transactions: Real-time settlement of tokenized assets and liabilities overcomes latency, human error and lack of interoperability between disparate systems. Atomic swaps: Trade finance deals can be executed as atomic end-to-end transactions rather than fragmented legs. 24/7 operations: Global markets can function without downtime as tokenized liquidity and assets move between time zones seamlessly. Lower counterparty risk: Simultaneous exchange of assets against liabilities on a shared ledger reduces settlement risk. Reduced costs: Operational costs are lowered through streamlined reconciliation and settlements and automation of manual processes. Regulatory-friendly: Citi's existing custody and compliance framework offers regulatory comfort for using digitized bank assets. Interoperability: Shared ledger between diverse entities enables frictionless transactions. Open standards may evolve. New revenue opportunities: Citi could offer the platform to other institutional players as a revenue stream.Citi in the Blockchain EcosystemCiti is strategically positioned to play a key role as blockchain adoption gains momentum: Already runs a digital assets unit providing crypto services to clients Has an industry-leading payments network with trillions in transaction volumes Partners with blockchain networks like Ethereum for enterprise use cases Engages with central banks exploring digital currencies across multiple countries Founding member of blockchain consortiums like R3 and Komgo aimed at building the technology Joined accelerator programs by regulators like FDIC and Banque de France to innovate Invests in blockchain analytics firms like TRM labs for risk insights and complianceGiven Citi's scale, relationships, and influence as a global custodian bank, its moves toward blockchain will encourage wider institutional participation.Real-World ImpactCiti's token service could have profound real-world impact by transforming existing business processes: Trade finance: Automating letters of credit and payment triggers would significantly reduce settlement times and costs. Cross-border transfers: Instant low-cost payments improve liquidity and cash flows for multinational corporates. FX markets: Reduced fragmentation and risk could spur wider adoption of blockchain-enabled forex platforms. Capital markets: Asset tokenization could enable instant settlement for securities trading and collateral swaps. Liquidity management: Banks can optimize liquidity pools in real-time across global affiliates using smart tokens. Wholesale CBDCs: Integration with digital currencies issued by central banks provides direct settlement.Challenges AheadDespite its promise, Citi also faces challenges for mainstream adoption: Regulatory uncertainty remains around digitized financial assets across jurisdictions. Maturing token standards for asset representation on blockchains is still underway. Business process change is required by financial institutions to support instant settlements. Interoperability with existing legacy platforms and banking networks needs to improve. Security risks, transaction privacy, and data compliance considerations exist. Competition from other blockchain platforms like Fnality, JPM Coin, etc. leveraging similar tokenized models.Citi's token service marks a key milestone in maturity and confidence in blockchain technology within institutional banking and global finance. By addressing real pain points like counterparty risk and latency, tokenization and smart contracts are proving their value for money movement and trade.This has positive portents for the broader adoption of blockchain-based financial market infrastructures. As more central banks explore wholesale digital currencies, the groundwork is being laid for an internet of value that allows seamless exchange of tokenized assets. Incumbent institutions are now taking the lead in transforming existing systems.While there are challenges around regulation, security and interoperability, Citi's moves are a promising step forward.Why Token Development MattersAs blockchain adoption grows, there is a rising need for robust token development platforms and services. Seamlessly creating, deploying and managing crypto-tokens is crucial for organizations looking to embrace token-based models.Some key capabilities offered by full-stack token development companies like RWaltz Software include: Expert guidance on selecting optimal blockchain networks for a token launch based on specific business needs. Public, private, hybrid - there are various network options. End-to-end technical development - writing smart contracts, programming token behavior, auditing security, deploying multi-signature wallets, etc. Proper token programming is critical. Adding advanced token features like mint/burn capabilities, whitelisting, access control, freeze options, and more to suit custom requirements. Enabling easy in-app integration so that tokens can be seamlessly used within products and services. Providing backend interfaces for viewing token analytics - supply, balances, transactions, holders, etc. Compliance analysis to adhere to evolving regulations surrounding crypto-tokens in different jurisdictions. Launch marketing services to drive visibility and adoption for a new token. Community building is vital.As tokens continue to transform many industries, the need for full-service token development platforms will keep increasing. Partnering with specialized companies like RWaltz Software can enable organizations to successfully leverage crypto-tokens for new business models and revenue streams.ConclusionTokens represent a fundamental shift in how value is created, owned, transferred, and used. Tokens enable new tokenized ecosystems where physical and digital assets can be easily controlled, fractionalized, programmed with conditions, and traded on blockchain ledgers.From NFT digital collectibles to decentralized finance applications, tokens are fueling blockchain innovation across sectors. As organizations recognize their benefits, demand for purpose-built token development services will grow. With robust token programming and launch support, businesses can strategically leverage crypto-tokens for new revenue streams and deeper customer engagement.

Driving Sustainability Through Waste Management Token Development

The accelerating global waste crisis demands new solutions. With municipal solid waste generation projected to reach 3.4 billion tons annually by 2050, legacy recycling and waste systems need to be improved given chronically low participation rates worldwide.Centralized models lack the incentives and traceability to fundamentally reshape consumer and corporate behaviors around waste. This is where blockchain-based crypto token development offers breakthrough potential.Purpose-built token economics and platforms can drive mainstream adoption of circular principles across consumption, collection, recycling, and recovery. However, effectively engineering tokenized incentives for sustainability requires specialized expertise.In this article, we dive into: The benefits of using crypto tokens for waste management Key technical considerations for developing waste & recycling tokens Real-world examples demonstrating the impact of adequately designed token solutions How our firm is leading the way in tokenized circular economy transformationLet's explore how crypto economics can revolutionize sustainability initiatives...The Potential of Waste Management TokensBlockchain-based crypto tokens allow directly incentivizing and rewarding positive waste behaviors like: Household recycling and proper waste separation Dropping off difficult e-waste at designated collection points Participating in community cleanup events and picking up litter Supporting green causes through donations and offset purchasesUsers can earn tokens through provable actions, which are directly redeemable for rewards like discounts, cashback, prizes, in-app perks, and more. The psychology of gamification and motivational design leads to lasting habits.For enterprises and municipalities, waste management tokens improve coordination and reduce costs through: Automating incentive disbursement based on RFID-tagged bin monitoring or other verification methods Directly engaging residents and businesses to improve practices through decentralized apps Receiving waste stream transparency to optimize logistics, manpower, fees, and recycling sortingOverall, blockchain-based token rewards aligned with sustainability behaviors show immense promise for catalyzing circular progress at scale by fixing the incentive layer.Technical Considerations for Waste Token DevelopmentLaunching effective crypto tokens for waste management requires specialized expertise across several dimensions:Behavior Modeling Token reward economics need a meticulous design based on incentivizing specific measurable waste actions. Advanced statistical models identify optimal incentives. Platform reward mechanisms are coded into smart contracts, allowing transparent automated disbursement.Distribution & Partnerships Tailored distribution strategies for token utility and rewards are crucial for driving adoption among target demographics. Establishing redemption partnerships allows users to spend earned tokens on desirable goods, services, and experiences.Platform Development Robust and intuitive mobile/web apps make participation seamless through features like automated waste weighing, image recognition, QR code validation, and gamified interactions.Token Engineering Precision minting algorithms dynamically manage token supplies as circulating demand shifts. This maintains balanced incentive economies. Compliance processes ensure adherence with global regulatory guidance around crypto tokens. Technical integrations relay sustainability metrics and proof of actions into smart contract triggers and chain data.Combined properly, these capabilities enable optimized tokenized circularity platforms engineered for real human behaviors and enterprise objectives.Proven Real World ResultsThe multiple end-to-end waste management token development projects producing measurable impact:34% Recycling Rate IncreaseThe tokenized incentives platform drove a 34% increase in recycling rates across 20,000 households in an Australian city within 5 months. Gamified features and rewards-aligned behaviors.8X Higher e-Waste Collection Event ParticipationAn e-waste program in Singapore saw 8X higher participation for collection events after launching our QR code-validated token rewards system. The incentive dramatically increased turnout.62% Less Recycling ContaminationPublic space recycling contamination decreased by 62% in a UK town following the introduction of RFID-monitored bins and token fines for repeat contamination offenses.These results validate that properly engineered token economics and platforms can indeed catalyze step-function improvements in sustainability through aligned incentives.Real-World Examples of Sustainability TokensThough still an emerging concept, concrete examples already demonstrate the promise: Plastic BankPlastic Bank incentivizes collecting ocean plastic waste by exchanging it for blockchain-secured digital tokens. These tokens unlock rewards like groceries and school fees, improving recycling participation. The tokenized model creates transparency, accountability, and efficiency in the plastic collection ecosystem. RecycleGORecycleGO gamifies recycling by allowing users to earn redeemable tokens by scanning and validating recyclable material barcodes. This incentive has shown positive results in boosting recycling rates in communities. The blockchain provides transparent tracking of all RecycleGO token transactions. CirculariseCircularise is developing a protocol to tokenize resources and track their sustainability metrics across entire product lifecycles on the blockchain. This brings unprecedented transparency to supply chains to identify ecological improvement areas. MirusMirus launched a decentralized trading marketplace where recyclers and manufacturers can buy and sell recycled plastic material streams more efficiently using the Mir token. This reduces friction and aligns incentives. PLOGPLOG's mobile app rewards users with tokens for plogging - picking up litter while jogging. The redeemable tokens incentivize positive environmental behaviors. PLOG leverages blockchain to transparently track user contributions.These real-world examples reveal crypto tokens are already driving sustainability forward. As the technology matures, adoption will accelerate.Benefits of Crypto TokenizationWell-designed crypto tokens unlock a range of sustainability benefits: Incentivization - Tokens directly reward positive ecological behaviors Transparency - Blockchains immutably record transactions, ensuring accountability Automation - Smart contracts automate incentive disbursement and sustainability metric tracking Participation - Token models boost grassroots participation in sustainability initiatives Decentralization - Crypto tokens enable decentralized coordination between consumers, companies, and communities Globalization - Borderless crypto networks overcome geographic limitations around sustainability.Tokenizing Waste Materials and Recycling ProcessesWaste management and recycling tokens are a new and innovative approach to sustainable waste management. These tokens are digital assets that represent the value of waste materials or recycling processes. They can be used to incentivize individuals and businesses to recycle, reduce waste, and support sustainable waste management initiatives.Blockchain technology is leveraged to tokenize waste materials and recycling procedures by creating a distributed ledger that records all transactions involving tokens. This ledger is transparent and immutable, meaning that it can be trusted by all participants in the system.Examples of the types of waste that can be tokenized include: Plastic waste Paper waste Metal waste Glass waste Electronic waste Food waste Incentivizing Responsible Waste ManagementWaste management and recycling tokens can be used to incentivize responsible waste management in several ways. For example, individuals can be rewarded with tokens for recycling specific materials or recycling in a certain way. Businesses can also be rewarded with tokens for reducing their waste production or supporting sustainable waste management initiatives. RecycleBank is a rewards program that gives users points for recycling. These points can be redeemed for discounts on groceries, gas, and other goods and services. EcoTerra is a blockchain-based rewards program that gives users tokens for recycling and using green energy. These tokens can be used to purchase sustainable products and services or to donate to environmental causes. Wasted is a Dutch rewards program that gives users green coins for recycling plastic waste. These coins can be redeemed at participating retailers for discounts on goods and services.Blockchain's Role in Transparency and TrustBlockchain technology enhances transparency and trust in waste management and recycling processes by providing a tamper-proof record of all transactions involving tokens. This allows consumers to verify the impact of their recycling efforts and ensures that all participants in the system are held accountable. Consumers can verify the impact of their recycling efforts by tracking the movement of their tokens on the blockchain. This allows them to see how their waste is being recycled and how it is contributing to the circular economy.Community and Corporate SustainabilityWaste management and recycling tokens have the potential to foster a sense of community involvement in sustainability by providing a platform for individuals to collaborate and support sustainable waste management initiatives. For example, communities can use tokens to create their recycling programs or to support local businesses that are committed to sustainability.Businesses can align their corporate social responsibility (CSR) goals with waste tokenization initiatives by rewarding their customers and employees for recycling or by investing in sustainable waste management solutions. This can help businesses to reduce their environmental impact and improve their reputation.Overcoming Challenges and Scaling UpThere are several challenges and barriers faced in implementing waste management and recycling token systems. These include: Public awareness and adoption Regulatory compliance Technical infrastructure requirements Economic sustainabilityStrategies for overcoming these challenges and scaling up token-based recycling programs include: Educating the public about the benefits of waste management and recycling tokens Working with regulators to develop policies that support the use of tokens Investing in technical infrastructure Developing partnerships with businesses and other stakeholdersThe Future of Green RewardsThe future of waste management and recycling tokens is bright. As more and more people become aware of the environmental benefits of these tokens, we can expect to see an increase in their adoption. Additionally, as the technology continues to develop, we can expect to see new and innovative ways to use tokens to incentivize responsible waste management and promote sustainability.This innovative approach can contribute to a more sustainable and circular economy by: Reducing waste generation Increasing recycling rates Promoting the use of recycled materials Reducing the environmental impact of waste disposalBlockchain-based tokenized incentive structures hold immense yet untapped potential to reinvent sustainability behaviors and systems. Global coordination and participation models become possible.However, the nuances of engineering effective crypto tokens for ecological impact require specialized expertise across technology, economics, psychology, and compliance.RWaltz provides full-service sustainability token development services tailored to your needs. Our end-to-end capabilities deliver results. Contact us today to learn more!Ready to boost sustainability through crypto economics designed for your use case? Let the seasoned experts at RWaltz make your vision a reality. Contact us today!Please Note: This article is provided for informational purposes only and represents the author's own opinions based on current market observations. All information herein is believed to be accurate at the time of writing but readers should do their own research #DYOR and due diligence.

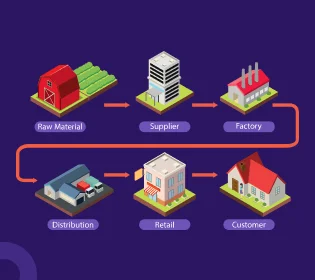

Transforming Food Supply Chains with Token Development Services

The global food industry today operates on antiquated supply chain systems riddled with inefficiency, waste, lack of coordination, and zero transparency between the numerous siloed parties involved. These include farmers, food processors, distributors, retailers, regulators, and finally consumers.Each stage in this fragmented sequence focuses solely on maximizing its profit, with little visibility or incentive to optimize the overall ecosystem. This leads to major problems including: Up to 40% of food is wasted given the lack of coordination on production, inventory, and demand signaling between supply chain stages. This simultaneously raises consumer costs and produces outsized carbon emissions. Fraud is rampant, with food counterfeiting expected to reach $40 billion annually by 2025 according to PwC. Consumers often cannot verify food provenance or validate ingredient claims. Brand reputations suffer. Recall costs average $10 million per incident according to Food Safety Magazine, resulting from the inability to pinpoint sources of contamination across fragmented supply systems. Regulatory compliance burdens and costs compound through supply chains as paperwork must be manually managed between disparate entities. This overhead gets passed to consumers. Producers receive minimal compensation, earning only roughly 14.25% of the ultimate sales value according to USDA Economic Research Service data. Intermediary middlemen siphon most value.These systemic problems demand radical transparency, disintermediation, coordination, and realignment between stakeholders. Legacy models are no longer viable for ecological, economic, or public health reasons.This is where blockchain-based crypto tokenization offers the breakthrough potential to transform the economics and incentives in food supply chains. By expertly leveraging crypto token models, transparency, trust, automation, provenance, and optimization can become a reality.However, food companies and farmers often lack the specialized expertise required to properly design and integrate blockchain solutions into legacy systems. This underscores the crucial need for trusted crypto token development partners who deeply understand the nuances and regulations governing global food supply chains.In this blog, we will dive into how custom crypto token development can utterly transform antiquated food chain infrastructure into transparent, efficient ecosystems serving all stakeholders. Let's explore.The Food Supply Chain DilemmaToday's food supply chains are linear sequences of largely siloed stages. Farmers sell commodities to processors, who transform ingredients before passing them to distributors, who then move goods to retail outlets.This centralized structure has major limitations: Lack of transparency In linear food supply chains, goods often change multiple hands from farm to table, passing through processors, distributors, and retailers. Once an item moves downstream, the prior entities have minimal visibility into what happens next. This opacity enables significant issues to be hidden or ignored by parties that don’t bear the consequences. For example, contaminated products may not be tracked back to the source, allowing processors to avoid detection and continue operating unsafely. Consumers lack transparency into how goods were handled at each prior stage. Coordination gaps The centralized linear structure also creates coordination gaps between siloed parties. Farmers lack timely demand signals on what crops and quantities retailers need. Distributors cannot automatically signal inventory shortfalls in real-time back to processors. Information delays result in overproduction, food waste, and lost revenue. Limited coordination also restricts optimizing supply plans and logistics across the entire chain. This greatly hinders overall efficiency and heightens costs. Trust deficiencies The lack of transparency across supply chain custody also breeds endemic trust issues. Fraud and counterfeiting are rampant, as evident in scandals like the 2013 horsemeat scandal in Europe. Producers frequently make false or misleading claims about ingredients, organic status, and origins. This damages consumer trust and brand reputation. But opaque supply chains allow this to persist since verification is nearly impossible. These trust deficiencies introduce major downstream risks after the point of sale. High costs The inefficiencies, waste, and lack of coordination induced by centralized linear supply chains saddle consumers with higher prices. Preventing waste could save $270 billion annually according to Harvard Business Review. Lack of transparency also leads to exorbitant recall expenses when issues finally surface. Overhead across fragmented middlemen also ratchets up costs passed to buyers. Producers receive minimal compensation, earning only roughly 15% of the final sale value. Better-aligned blockchain-based models can optimize incentives and economics.In essence, the current food supply chain infrastructure is fragile, opaque, and misaligned. This necessitates blockchain-based reengineering.Benefits of using the token There are several benefits to using token services to transform food supply chains, including: Transparency: Blockchain-based food supply chain solutions can provide a high degree of transparency, allowing all stakeholders to see where food is coming from, how it is being processed, and when it is expected to arrive. This can help to reduce food fraud and counterfeiting and build trust between consumers and businesses. Efficiency: Blockchain can help to streamline food supply chain processes and reduce costs. For example, smart contracts can be used to automate payments and other transactions, and blockchain-based tracking systems can help to reduce the need for paperwork and manual data entry. Sustainability: Blockchain can help to make food supply chains more sustainable by tracking the provenance of food and ensuring that it is produced and transported sustainably. This can help businesses to reduce their environmental impact and meet consumer demand for sustainable food products.Real-World Examples of Crypto Tokens & Blockchain Improving Food Supply ChainsThough still an emerging concept, real-world initiatives are already showcasing the power of blockchain technology and crypto tokens to optimize food supply chain transparency, efficiency, and sustainability. TraceTrac.io At TraceTrac.io, we believe supply chains are on the cusp of a digital transformation driven by blockchain technology. However, realizing the potential requires purpose-built solutions tailored to each customer's unique needs and use cases.This is why TraceTrac.io partners closely with enterprise clients to develop integrated blockchain platforms unlocking transparency, resilience, and efficiency across their supply chains.Our approach combines deep supply chain expertise with leading-edge blockchain capabilities:Supply Chain Insights We conduct in-depth analysis of existing client supply chain workflows, pain points, and objectives. This sets an informed foundation. Our team includes supply chain veterans from industries like agriculture, pharmaceuticals, and manufacturing. We understand the nuances. Scoping collaborative workshops uncover the highest potential use cases to drive measurable ROI.Blockchain Platform Development We architect and develop custom blockchain solutions using frameworks optimized for enterprise needs like Hyperledger Fabric. Our full-stack engineers have specialized expertise in blockchain architecture patterns and integration best practices. We seamlessly bridge IoT sensors, legacy systems, and data feeds into our blockchain platforms leveraging APIs and cloud services. SLAs, data security, permissions management, and governance are baked into every solution per enterprise requirements. We leverage leading-edge capabilities like public/private transaction networks, zero-knowledge proofs, and state channels.Go-Live and Support We provide hands-on support during platform go-live including user onboarding, DevOps, and change management. Our expertise ensures seamless transitions from legacy approaches into new blockchain-driven workflows. We offer ongoing support, platform enhancement, and supply chain consulting once live.By leveraging TraceTrac.io's blended capabilities, leading enterprises can finally leap into transformative blockchain-powered supply chain networks built for their specific needs. This is the future of resilience and efficiency.How TraceTrac.io works: A farmer grows a tomato on their farm. The farmer registers the tomato with the TraceTrac.io platform and is assigned a unique token for the tomato. The farmer sells the tomato to a distributor. The distributor scans the tomato's token to record the transfer of ownership. The distributor sells the tomato to a retailer. The retailer scans the tomato's token to record the transfer of ownership. The consumer purchases the tomato from the retailer.This enables tracing origin, handling, and custody down to the ingredient level. For example, a grocery store could use TraceTrac.io to track tomatoes from farm to store shelf, enabling quick containment in case of recalls. Scanning a QR code on the tomato packaging would reveal the full history of the tomato on its journey through the supply chain.Here are some additional benefits of TraceTrac.io: Flexibility with dynamic field creation: TraceTrac.io allows businesses to create custom fields to track the specific data that is important to them. This makes the platform flexible and adaptable to a wide range of supply chains. Product history recording: TraceTrac.io records the complete history of each product, including its origin, production methods, and shipping routes. This information can be used to ensure the quality and authenticity of products, as well as to investigate any potential problems. Lifecycle monitoring: TraceTrac.io provides real-time visibility into the status of products at each stage of the supply chain. This helps businesses to identify and address any potential delays or disruptions. Smart contracts: TraceTrac.io uses smart contracts to automate and streamline the supply chain process. This helps to reduce costs and improve efficiency.TraceTrac.io is a powerful blockchain-based supply chain management platform that can help businesses improve the traceability, transparency, efficiency, and quality of their supply chains. Let's connect today to RWaltz and optimize your supply chain workflows. IBM Food Trust IBM Food Trust uses blockchain to track food items digitally through each step of the supply chain. When a food product gets entered into the network, it gets assigned a unique token ID persisting as ownership changes hands.How IBM Food Trust works: A farmer raises a pig on their farm. The farmer registers the pig with the IBM Food Trust platform and is assigned a unique token for the pig. The farmer sells the pig to a slaughterhouse. The slaughterhouse scans the pig's token to record the transfer of ownership. The slaughterhouse slaughters the pig and processes the meat. The slaughterhouse sells the meat to a distributor. The distributor scans the pig's token to record the transfer of ownership. The distributor sells the meat to a retailer. The retailer scans the pig's token to record the transfer of ownership. The consumer purchases the meat from the retailer.This enables tracing origin, handling, and custody down to the ingredient level. For example, Walmart uses IBM Food Trust to track pork from farm to store shelf, enabling quick containment in case of recalls. Scanning a QR code reveals the full history of a food product on its journey through the supply chain. Provenance Provenance also utilizes blockchain product tokens to track transparency data across supply chains.How Provenance works: A farmer raises a cow on their farm. The farmer registers the cow with the Provenance platform and is assigned a unique token for the cow. The farmer sells the cow to a slaughterhouse. The slaughterhouse scans the cow's token to record the transfer of ownership. The slaughterhouse slaughters the cow and processes the meat. The slaughterhouse sells the meat to a distributor. The distributor scans the cow's token to record the transfer of ownership. The distributor sells the meat to a retailer. The retailer scans the cow's token to record the transfer of ownership. The consumer purchases the meat from the retailer.However, it focuses on providing this production information directly to consumers. For example, Marks & Spencer employs Provenance to let shoppers scan QR codes on food to learn its provenance, ingredients, and environmental impacts.This allows brands to build consumer trust by unveiling the origins and processes behind their offerings. Access to product history helps shoppers make informed choices aligned with their values. FairChain FairChain leverages blockchain product tokens to create more equitable supply chain relationships between producers, buyers, and vendors. Farmers get registered on the network and receive tokens representing their goods.Here is a more detailed example of how FairChain works: A cocoa farmer in Ghana grows cocoa beans. The farmer registers with FairChain and is assigned a unique token. The farmer sells their cocoa beans to FairChain. FairChain gives the farmer a digital token that represents the value of their cocoa beans. The farmer can then use this token to purchase goods and services from other FairChain participants, such as buyers, suppliers, and service providers. For example, the farmer could use their token to purchase fertilizer from a FairChain supplier or to pay for their children's school fees.Here are some of the benefits of using FairChain:For farmers: Get better prices for their products Access to market information and financial services Reduce their reliance on middlemenFor buyers: Access to a wider range of products from sustainable and ethical sources Reduce their risk of buying counterfeit or contaminated productsFor consumers: Have more information about the products they buy Support sustainable and ethical agriculture Help to reduce poverty and inequalityFairChain is a valuable tool for creating a more equitable and sustainable food supply chain.They can then exchange these tokens for necessary goods and services on the network, removing exploitative middlemen extracting value. This transparent tokenized structure of FairChain ensures farmers earn fairer compensation by directly connecting them with retailers and customers. FoodCoin FoodCoin is a cryptocurrency used to purchase sustainably sourced food on partner farms and retailers. As a blockchain-based token, FoodCoin allows buyers to vote for sustainable agriculture using their wallets. Customers can also scan QR codes to learn more about the provenance of their FoodCoin purchases.Here is how FoodCoin can be used in the food supply chain: A farmer who uses sustainable practices grows a crop of tomatoes. The farmer sells the tomatoes to a distributor who accepts FoodCoin. The distributor sells the tomatoes to a retailer who accepts FoodCoin. A consumer purchases the tomatoes from the retailer using FoodCoin. The retailer uses the FoodCoin to purchase more tomatoes from the distributor. The distributor uses the FoodCoin to pay the farmer for the tomatoes.The token creates transparency between consumers and producers, ensuring money flows to ethical farmers. This incentivizes further sustainable practices. TE-FOOD TE-FOOD utilizes blockchain to track the farm-to-table journey of food products like eggs. TE-FOOD Supply chain participants scan QR codes at each checkpoint to log custody chains transparently. This brings real-time traceability to inventory flows and food origins, enhancing safety, freshness, and accountability across decentralized networks.These examples reveal how blockchain and crypto tokens can transform legacy supply models through transparency, automation, and aligned incentives. Sustainability, efficiency, and consumer trust are all enhanced. More initiatives will undoubtedly emerge as the technology advances across agricultural production, processing, distribution, and retail.RWaltz Token Development ServicesHowever, most supply chain operators lack the blockchain expertise to implement token solutions. This is where partnering with RWaltz, a specialized token development company comes in.Working with experienced teams provides the technical skills and solutions required, including: Modeling unique tokenomics engineered for supply chain behaviors Programming extensively tested smart contracts that encode business logic Architecting blockchain data integrations with legacy IT systems Delivering intuitive operator and consumer interfaces Ensuring compliance with food industry regulations Providing exchange integration and liquidity servicesBy relying on seasoned token development partners, food companies can adopt crypto solutions seamlessly without needing to build internal blockchain competencies. The results are next-generation supply chains that are transparent, efficient, and cost-effective.As consumer demands for transparency grow, food companies have an opportunity to leapfrog to the future of supply chain management through tokenized solutions. Partnering with RWaltz token development services unlocks the benefits of blockchain without the risks and costs of internal R&D. Now is the time for forward-thinking food enterprises to capitalize on crypto-driven supply chain innovation.Transform your food supply chain using the power of blockchain technology and crypto tokenization. Get in touch today to book a discovery session with our supply chain tokenization experts.Please Note: This article is provided for informational purposes only and represents the author's own opinions based on current market observations. All information herein is believed to be accurate at the time of writing but readers should do their own research #DYOR and due diligence.

Enhancing Digital Content Distribution with Token Development Services

The digital content and media industry has undergone massive disruption in recent years. From music and movies to books and journalism, traditional distribution models have been upended by digitization and piracy. At the same time, blockchain technology is emerging with new capabilities around transparency, automation, incentives, and decentralization.By leveraging token development services, innovative models for digital content distribution, engagement, and monetization can be created. Crypto tokens allow aligning incentives between creators and consumers in new ways while unlocking decentralized participation.The Digital Content DilemmaThe internet has enabled content to be copied and shared at negligible cost. This has decimated profits and jobs for traditional publishers, studios, and labels. Rampant piracy continues eroding revenues.At the same time, content intermediaries like streaming platforms and app stores exert enormous power through centralized control. Middlemen extract substantial fees and data.Creators are stuck between dwindling royalties and predatory gatekeeper platforms. Without incentives, production quality and diversity suffer. Users have limited ways to directly reward artists.There exists a misalignment - users want diverse affordable content, while creators need sufficient incentives to earn a living. Crypto token models offer a solution.Benefits of TokenizationThoughtfully integrating crypto token economics into digital content platforms unlocks new benefits: Crowdfunding - Creators can raise funds directly from fans early in production through token sales. Backers are rewarded with platform usage rights, shares of revenue, or speculative tokens. User Participation - Consumers gain tokenized platform ownership and voting rights by staking consumption credits or purchases. This engages communities. Transparency - With usage data and payments on blockchain, accurate attribution and transparency around royalties emerge. Micropayments - Smaller frictionless transfers become feasible using tokens, allowing new monetization down to per-view or per-listen. Automated Royalties - Smart contracts can encode business rules for instant automated distributions of royalty payments to content owners per stream or view. Secondary Markets - Users can resell digital goods like limited edition albums or artworks using non-fungible tokens. Scarcity and provable ownership drive value. Decentralized Distribution - With censorship-resistant platforms, creators can publish controversial work without centralized intervention.Overall, crypto token models realign incentives between users, creators, and intermediaries in the digital content equation. Value flows become transparent, permissionless, and programmable worldwide.Real World ExamplesEarly movers are already innovating with crypto tokens to transform digital content platforms: Basic Attention Token (BAT) The BAT token underpins a new digital advertising model that reduces fraud while rewarding engagement. Users opt into privacy-preserving ads via the Brave browser and earn BAT proportional to their attention. Advertisers purchase ad inventory with BAT instead of fiat currencies. Publishers receive BAT based on user attention measured through Brave's analytics. This better aligns incentives between users, advertisers, and publishers. Audius (AUDIO) Audius is a decentralized music-sharing platform that lets artists distribute songs directly to fans. Listeners can support artists through tips denominated in AUDIO tokens. Additional rewards engage fans in growing artists’ reach through sharing playlists, commenting, and participating in discovery. This incentivizes viral marketing. The Audius protocol removes intermediaries that previously extracted excessive fees in the music industry value chain. Theta Network (THETA) Theta Network is a decentralized peer-to-peer video delivery network, powered by its native THETA token. Viewers can earn THETA by sharing spare bandwidth and resources, creating a community-driven video CDN. This improves delivery quality and cuts costs for content platforms. Theta aims to tackle the high costs of traditional centralized video streaming infrastructure through token-incentivized distributed relaying of content. Filecoin (FIL) Filecoin is a decentralized storage network designed to store humanity's most important data. FIL token incentives coordinate a marketplace where users provide spare storage and retrieval capacity. Content platforms and creators can benefit from reliable decentralized storage to preserve valuable data. Token rewards incentivize reliable long-term file storage while lowering costs. Steemit Steemit is a blockchain-based social media platform that rewards content creators and curators with STEEM tokens based on community votes and engagement. This creates a tokenized incentive model for user-generated content compared to traditional platforms. Steemit operates as a decentralized network based on community consensus, without centralized intermediaries extracting value. Choon (NOTES) Choon is an Ethereum-based music streaming service that connects artists directly with listeners. Artists are compensated in NOTES tokens each time their songs are streamed or downloaded. This provides transparent, near-instant royalty payments using smart contracts based on exact listener metrics. Artists also have control over pricing. The platform cuts out excessive record label fees. LBRY (LBC) LBRY is a community-driven digital marketplace for creators to publish and be compensated fairly in LBC tokens. The decentralized protocol aims to provide censorship-resistant sharing of information and content. LBRY allows publishers across video, books, music, and more to monetize directly from consumers. Downloads and API access require LBC payments to creators. SingularDTV (SNGLS) SingularDTV utilizes the SNGLS token to coordinate tokenized crowdfunding and revenue distribution for film/TV production and music creation. Rights management, project funding, and royalty transfers are streamlined using SNGLS tokens on Ethereum. SingularDTV aims to empower a new generation of artists and creators with blockchain-based tools to retain rights and raise capital. Livepeer (LPT) The Livepeer network enables affordable live video streaming by incentivizing a distributed workforce of computational resource contributors with the LPT token. Platforms request video transcoding services to LPT miners, creating a decentralized open marketplace. By cryptoeconomic coordination, the network matches transcoding capacity with demand at a low cost. Library Credits (LBC) Library Credits is a decentralized content marketplace where users can publish, curate, access, and purchase digital books, blogs, videos, and more using LBC tokens. Library Credits aims to be a censorship-resistant knowledge repository. Reader-driven discovery and compensation incentivize content creation. The protocol reduces intermediary fees and risks.Technical ArchitectureFor digital content platforms looking to integrate token models, partnering with blockchain experts is recommended to navigate the architecture: Token Design - The token economics and incentivization model need a meticulous design based on the platform's behaviors and goals. Scientific modeling is required. Smart Contracts - Programming complex royalty distribution, voting, vesting, and other logic into extensively tested smart contracts is essential. Wallet Integration - Making it easy for users to store and spend tokens is key for adoption. Custody solutions may be required. User Interfaces - Well-designed interfaces, apps, and APIs result in a seamless integration into the user experience. Blockchain Interoperability - Bridging on-platform activity and metrics to public blockchains to trigger token transactions and contracts. Regulatory Compliance - Navigating global regulations around token issuance and distributions requires specialized legal expertise.By leveraging token development services for these technical needs, digital content platforms can focus on their core use case and UI, while experts handle complex blockchain integrations.The Tokenized Future of Digital ContentLooking ahead, crypto-empowered models of crowdfunding, incentives, microtransactions, and decentralized participation can redefine digital content creation, sharing, and consumption.Initiatives like Audius, Publish0x, and Float highlight a better path aligned with creator and consumer interests, rather than legacy intermediaries.For pioneers in digital content, partnering with blockchain experts unlocks the full potential of crypto to realign incentives and value flows in this industry. RWaltz offers specialized token development services tailored to your exact use case and technology needs.The digitization genie is out of the bottle - innovative crypto token models offer a way to bottle the value. Contact our experts today to learn more about the revolutionary possibilities of tokenized digital content ecosystems.Transform your digital content platform through purpose-built crypto token models that align incentives between creators, consumers, and intermediaries.RWaltz delivers full-service token development tailored to your digital content use case including: Modeling smart token incentivization dynamics Programming extensively audited smart contracts Architecting blockchain integrations and wallets Launch planning and exchange listings Ongoing supply management and securityGet in touch today to schedule a consultation and jumpstart your tokenized future!Please Note: This article is provided for informational purposes only and represents the author's own opinions based on current market observations. All information herein is believed to be accurate at the time of writing but readers should do their own research #DYOR and due diligence.

Tokenizing the Renewable Energy Revolution