CBDC- A New Revolution into the FinTech!

Blockchain Development is leading the edge over the tech trends and transforming the way business is done. Majorly, Blockchain Technology has revolutionized the traditional financial ecosystem with Defi Development by introducing a decentralized version of fund transfer.

Now, a new trend in the Blockchain space has captured the attention of the fintech and that is CBDC- Central Bank Digital Currency.

A Deep Dive into Central Bank Digital Currency (CBDC)

Central Bank Digital Currencies (CBDC) are termed digital tokens, just like the cryptocurrencies that are issued by a central bank or a nation’s monetary authority. These currencies are assigned the value of the specified country’s fiat currency. In other words, it is defined as the digital form of the country’s fiats.

Countries across the world are developing CBDCs and many of them have already implemented them. With countries transitioning to a digital age, understanding CBDC becomes crucial to explore its effects on economies, existing financial networks, and stability.

Let’s go into detail to explore more.

Discover the Types of CBDCs for a Detailed Outlook!

There are two types of Central Bank Digital Currencies (CBDCs), which are wholesale and retail. Let’s explore more about them.

Wholesale CBDCs

Wholesale CBDC is much like financial institutions that hold reserve deposits with a central bank. It enhances the payments and security settlement efficiency, also eliminating liquidity risks. These CBDCs are mostly used in an interbank system to check the effects of cross-border payments.

Retail CBDCs

Retail CBDCs refer to government-backed digital currencies which are used by businesses and consumers. These CBDCs generally eliminate the intermediary risks associated with the bankrupting of private digital currency issuers and losing of customer assets.

Check Out Why CBDCs are Gaining Momentum!

- A CBDC eliminates all the third-party risks associated with the system like bank failures, liquidity risks, etc.

- It lowers the cost of cross-border transactions by reducing complex distribution systems and raising the jurisdiction cooperation between the governments.

- CBDCs can directly establish the connection between central banks and consumers, thus removing the need for expensive infrastructure.

- The dollar being one of the most preferred currencies across the world, a U.S. CBDC supports and preserves its dominant position.

- Cryptocurrencies being highly volatile, CBDCs provide businesses and consumers with stable means of exchanging digital currency.

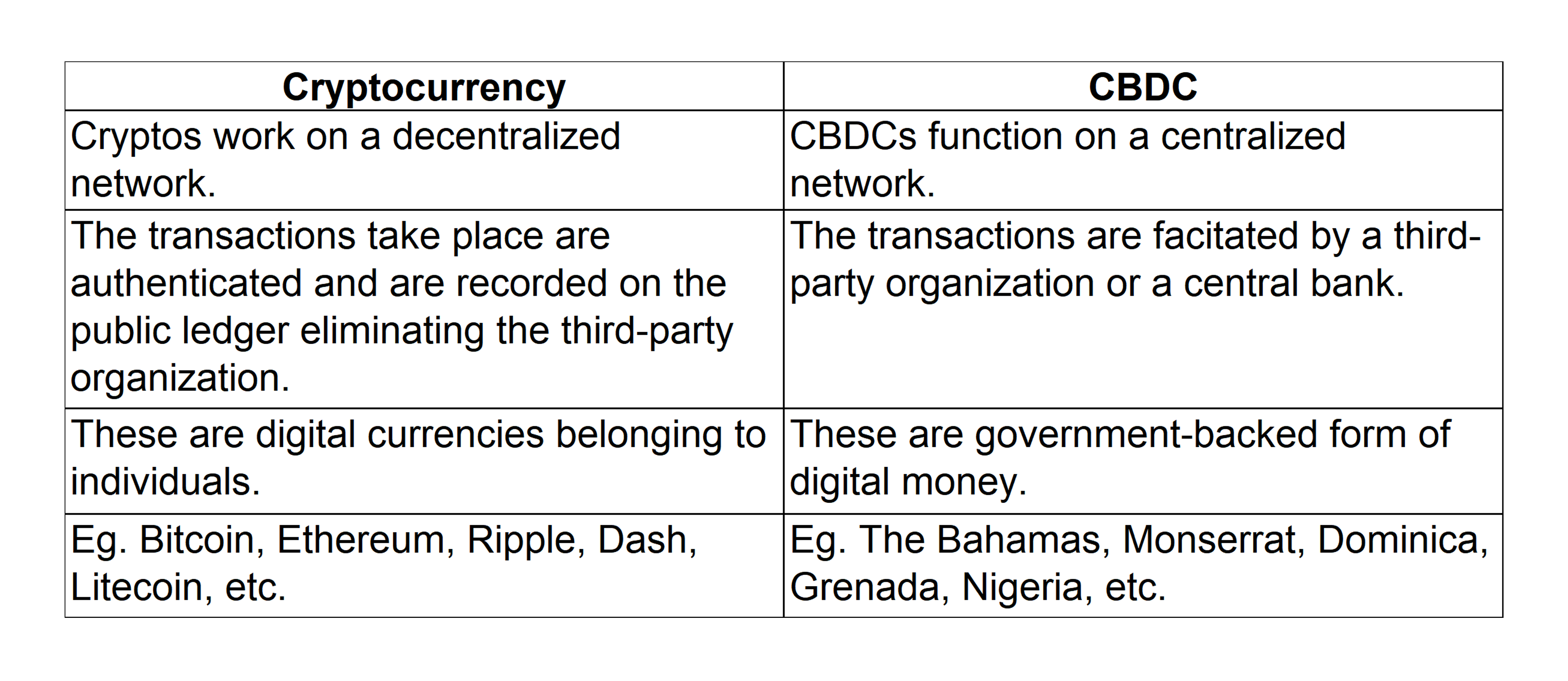

CBDCs Vs Cryptocurrencies- Are They Similar?

RWaltz- Pioneers in Blockchain Development Services

RWaltz is a leading Blockchain Development Company with a wide range of services like cryptocurrency development, token development, NFT Marketplace Development, Coin Listing, Launchpad Development, Crypto Exchange Development, DeFi Development, DApp Development, Smart Contract Development, Smart Contract Audit, and much more. Clients across business verticals trust us for our service excellence. If you are looking for a Blockchain Development Company, connect with us! Schedule a demo now!

Wrap Up

Hopefully, the above article has enlightened your knowledge of CBDC. The future is near when these digital currencies will revolutionize the fintech sector with their storming use cases.

Recent Knowledge Base

- The Benefits of Fractional NFTs

- Demystifying Token Standards: A Beginner's Guide to Finding the Right Fit for Your Blockchain Project

- 250+ Gaming NFT Ideas to Engage the Users

- Understanding Distributed Ledger Technology (DLT) in Blockchain

- Algorithms in AMM for DEX Development

- The Effects of PayPal's Stablecoin on Global Banking

- What are the benefits of Crypto Staking?

- What is Blockchain Interoperability in Transactions across Crypto Exchanges?

- Multi-Signature Crypto Wallets: The Future of Organizational Decision Making

- White Paper- The Crux of Blockchain Projects!

Categories

Latest news, articles, and updates montly delivered to your inbox.