Search Blogs

50 Blockchain Terminologies Which are Commonly Used

Blockchain technology is disrupting almost every sector in the world. This technology is making revolutionary changes in many industries and growing rapidly, so the terminology surrounding it. There are many terminologies used in blockchain technology. Each has its own significance & meaning. To utilize blockchain technology effectively, one must know all related key terms which are explained below:1. Address: An address is a very important term in the blockchain. It is nothing but a unique identifier used to identify the sender & receiver. A private key is used to generate an address that is unique to the address. Generally, the address is in the form of alphanumeric characters.2. Application Specific Integrated Circuit (ASIC):It is a type of computer processing chip that performs a singular function. ASIC boards have been used in the blockchain industry, to perform SHA256 hashing which is required for Proof-of-Work(PoW).3. Airdrop:Airdrops are related to blockchain projects, specifically ICOs. It is all about distributing free tokens to people as rewards. Airdrop may or may not have incentives attached to it. 4. Block: Transactions are stored into single and a new block of size 1MB is created every 10 minutes. Every block comprised 4 components: a summary of included transactions, a timestamp, reference to the previous block, and the Proof of Work.5. Block Depth:Block depth is defined as a block's position index in the blockchain relating to the most recently added block. A block that is seven blocks before the latest block will have a block depth of 6.6. Block Height:Block height is defined as a block's position index in the blockchain relating to zeroth block. The 10th block added in the chain will have a block height of 10.7. Block Reward:It is a reward that a miner gets after solving the block successfully. Miner adds the first transaction on the block, to claim the reward. The entire process starts with miners searching for blocks to be verified. After the block is found, transactions on the blocks are verified by solving a certain mathematical formula for the reward to be processed. Also, this reward is shared between the group of miners depending on the amount of work they have done.8. Blockchain:Blockchain is distributed ledger technology. It consists of nodes that carry a copy of the decentralized ledger. It can be described as a structure that stores transactional records in chronological order while maintaining security, transparency, and decentralization.9. Blockchain 1.0: The first generation of blockchain technology performs simple token transactions. Bitcoin is the most prominent example of Blockchain 1.010. Blockchain 2.0: The second generation of blockchain technology focuses not only on exchange transactions also on coding and programming in the form of smart contracts. Ethereum is the first of the blockchain 2.0 generation.11. Blockchain 3.0: This generation of Blockchain Development is an upgraded version of blockchain 2.0 with more focus on interoperability and scalability. The most promising blockchain 3.0 project is SkyCoin.12. Coin: A coin is a digital asset that is native to its own blockchain. E.g. Bitcoin, Ether, Litecoin, etc. Bitcoin functions on its own blockchain i.e. Bitcoin blockchain similarly Ether operates on the Ethereum blockchain.13. Consensus: The consensus is the process through which nodes agree on a single point of the data value in the network. There are various types of consensus algorithms such as Proof of Work (PoW), Proof of Stake(PoS), and Delegated Proof of Stake (DPoS).14. Consortium Blockchain: It is a semi-private blockchain that is controlled by two or more groups of companies. These chains would be appropriate for two or more parties that need immutable communication.15. Cryptocurrency: A cryptocurrency is a digital currency created as a medium for exchange that used cryptography to secure financial transactions.16. Cryptocurrency fork:A cryptocurrency fork is a process by which existing software protocol is split into two versions. A cryptocurrency fork happens when developers alter the source code to add new features resulting in two chains.17. Fork Hard:It means a change in software protocol makes two co-existing versions incompatible with each other. New blocks do not support old ones. In this case, all users have to work on a newer version of the network to stay in sync with the network.18. Fork Soft:It is a software upgrade that is compatible with old & new versions. It is called backward compatible, which means users won't be cut off from the network if they fail to upgrade the software.19. Cryptography:It is a technique used to secure communication between two or more parties by encrypting information.20. Bitcoin: It is one of the blockchain cryptocurrencies stored on a digital wallet. People can send or receive Bitcoins with this digital wallet. Every transaction is stored in a public list i.e. blockchain.21. DApp: DApp is an abbreviation for decentralized applications. These applications cannot be controlled by anyone without permission. That’s why decentralized! Decentralized apps need to be open-source, with the use of blockchain technology. DAPP is an open-source software platform implemented on decentralized blockchains. The token required for DApp has to be generated by the DAPP developers by programming the algorithms22. Decentralization: Decentralization is the process of distributing information collected to each node in the network.23. Decentralized Autonomous Organization (DAO): Decentralized Autonomous Organization is created by developers to automate decisions and facilitate cryptocurrency transactions.24. Distributed Ledger Technology (DLT): Distributed Ledger Technology is a digital system used for storing transactions & their details at multiple places at the same time. Unlike, traditional systems, distributed ledgers do not have central data administrators.25. Double Spend Attack: Double Spend Attack is a malicious activity performed by a miner or group of miners trying to spend crypto’s twice on the blockchain.26. Ether: Ether is a cryptocurrency for the Ethereum blockchain. It is provided as a reward to the nodes which validate the blocks on the Ethereum blockchain.27. Ethereum: Ethereum is an open-source platform with the ability to create a smart contract and develop, deploy, and maintain decentralized applications. This platform is fueled with its native tokens called Ether.28. Ethereum Classic: Ethereum Classic (ETC) is another cryptocurrency that came into existence after a hard fork happened on the Ethereum blockchain. This is when the big Ethereum Decentralized Autonomous Organization was hacked. As it was hard forked means it carries the properties of the Ethereum chain.29. Ethereum Gas: Ethereum gas is used as a basic unit to calculate the computational effort required to perform a transaction on the Ethereum blockchain. 30. Ethereum Virtual Machine: Ethereum Virtual Machine is a simulated state machine within each Ethereum node that is responsible for executing contract bytecode.31. Federated Blockchain: Federated Blockchain is simply an updated form of the fundamental blockchain model, which makes it additionally perfect for some specific use cases. It provides a private blockchain and a more customizable perspective. Federated blockchains are very like private blockchains, with a few additional features.32. Fiat Currency: Fiat money is issued and controlled by the government & is not backed by a physical commodity like gold or silver but instead backed by the government that issued it.33. Gossip Protocol: It is the process by which nodes in the network transfer information with all other nodes. When a node receives new information, it sends it to every other node in the network. Eventually, all nodes will have some piece of information as they all are connected.34. Hash: It is a cryptographic value that is generated by mapping the input of numbers and letters into an encrypted output.35. Hash Collision: A hash collision occurs when two different inputs hash the same value.36. Hashgraph: It is a distributed ledger that uses a gossip protocol to communicate transactions and tangle-style consensus algorithms.37. Hashrate: Hashrate is the speed at which a particular machine performs a hashing function. It is calculated as the number of times that machines can perform specific hash functions per second.38. Hash function: It is a cryptographic function that converts specific input into an encrypted output.39. Hyperledger: A framework of tools offered by IBM & hosted by the Linux Foundation to develop enterprise-level consortium chains.40. ICO: ICO stands for Initial Coin Offering. It is a fundraising mechanism through which new projects sell their crypto tokens in the exchange of cryptocurrencies.41. Immutability: Immutability is the ability of blockchain to remain unaltered or unchanged. Immutability is achieved because of decentralization.42. ERC20: ERC20 is the abbreviation of "Ethereum Request for Comments". It is the standard protocol used to issue tokens on the Ethereum network.43. Proof-of-Work (PoW): Proof-of-Work is a famous consensus algorithm utilized in blockchain networks. The process starts with assigning a block to the miners then miners solve them with a computational puzzle. It requires computational power to do so. Upon succession, miners are rewarded with blockchain tokens or value.44. Proof-of-Stake (PoS): Proof-of-Stake is another consensus algorithm. The nodes in a PoS based blockchain stake coins. Nodes with more stake coins have higher chances to be picked for making consensus decisions.45. Smart Contract: A smart contract is a self-executing agreement embedded in computer code and managed by blockchain. This code contains a set of instructions agreed by parties to that smart contract.46. Security Token Offering (STO): Security Token Offering is a kind of public offering in which security tokens are sold in cryptocurrency exchanges.47. Stable Coins: Stablecoins are new types of cryptocurrencies whose value is backed by another fixed asset like the US dollar. These coins can be pegged to fiat currency, for example, the US dollar, different digital forms of money, valuable metals, or a combination of the three. Fiat is likely a mainstream alternative in the marketplace nowadays, which means one unit of a stable coin equals $1.48. Token: The token is another synonym for cryptocurrencies that act as an asset or utility and reside on their own blockchain.49. Utility Token: A utility token is a digital asset used to finance the network where its buyers can consume some of the network's products.50. Security Token: A security token is another cryptographic token that is offered to investors after they invest in an ICO as a digital asset and act as financial security on the blockchain.Wrap upTo explore Blockchain Development, it is crucial to understand the terminologies mentioned above. To know more about Blockchain Development, take a look at the solutions offered by RWaltz.

Blockchain To Play Vital Role in Diamond Industry

In recent years, Enterprise Blockchain has transformed various industries ranging from healthcare to finance. With huge investment potential, the Diamond industry faces certain challenges concerning Provenance, Supply Chain Traceability, Third-Party, verification process, and reliable transactions.Bitcoin and a wide range of cryptocurrencies use Blockchain to integrate the trust factor in the community to securely execute business operations. For example, ensuring seamless international transactions in one go.Before 2000, a diamond's way from the mine to a retail deal was not closely tracked. In the year 2000, the United Nations set up the Kimberley Process "forces extensive requirements on its members to enable them to certify shipments of raw diamonds as 'conflict-free' and avoid conflict diamonds from entering the legitimate exchange"The Diamond industry faces challenges like document altering, fake cases, synthetic stones that are falsely identified, and double financing that are difficult to trace. There is an urgent requirement for a single point of truth so that all parties on the supply chain, from makers to cutters to investors and insurance providers, have shared access to records documenting diamond mining, assembling, and sale.Stages of Diamond ProcessingDiamond experiences a multistage process between the mine and the jewelry store.● Mining – Diamond mining is considered to be a combination of art, science, engineering, and a lot of hard work. According to a report, 142 million carats of diamonds were estimated to have been produced from mines worldwide in 2019.● Sorting and Pricing – Rough diamonds are arranged into more than 5,000 classifications. Just about 20% of all rough diamonds are of gem quality, while 80% of the diamonds dug are sold for industrial purposes. Diamonds are valued and offered to makers at one of ten yearly markets, called sights.● Assembling – Gem-quality stones are bought by cutting centers. The rough stones experience a 3-D scan to make a PC model. Specialists analyze each rough stone concerning its size, shape, and the amount and position of its inward structure and flaws, and update the PC model. Then, they conclude how to cut the stone to create the greatest value.● Turning into a Gem – The stone is then stamped and divided or sawed with a jewel saw or laser. A few diamond cutters, each with their own specialty, help produce the gem. Polishing additionally is a multistage procedure, with various specialists polishing the fundamental features of the gem and others polishing the final aspects. The last step is quality control to check the gem's attributes and guarantee that it satisfies the maker's guidelines. It may be recorded by laser with an ID number.● The Sale – The finished diamond will be offered to jewelry manufacturers and wholesalers. They, in turn, offer the gem to customers, or retail diamond sellers and jewelry outlets.Putting Diamonds on the BlockchainTo ensure transparency in the diamond industry, Enterprise Blockchain can be utilized. Additionally, with the help of software to interface with the scanning, modeling, and cutting equipment utilized in gem manufacturing these instruments could automatically store and generate the data related to the manufacturing process on the Blockchain.At each phase of manufacturing, Blockchain makes it easier to trace the time and date of procedure,craftsman performing, price entered by retailers, store area, warranty details, etc.Keeping Fraudulent AwayThe weak part of any technological system is human intervention. Enterprise Blockchain Development Solutions overcomes this weakness by utilizing digital signatures. For example, when a certified mine puts a diamond on the Blockchain, it signs the transaction with its private key. The signature can be checked by anyone utilizing mine's public key. This implies the mining organization cannot later deny that it was the source of the diamond. Similarly, a rogue company cannot put a diamond on blockchain claiming to be a certified organization because a rogue organization'sa signature will be seen quickly as being invalid.ConclusionThe blockchain, combined with digital signatures and machine-to-blockchain software, gives a method for safely recording the provenance of diamonds and different products. Customers can easily check the movement of a product recorded on the chain from its source to the present. This transparency increases the value of the product at each point in the supply chain and in its possible purchase by the customer.Enterprise Blockchain Development Companies like RWaltz offer efficient services to a wide array of clients. Take a look at how RWaltz is serving the industries with Blockchain Development.

Smart Contract Development: Everything You Need to Know

Blockchain Technology and Smart Contracts have turned out to be a matter of interest these days. With the growing popularity of cryptocurrencies, Smart Contracts have turned to be a buzz in the crypto world.What are Smart Contracts? A Smart Contract is defined as a software or program that is executed when the predefined conditions are met. Defining the rules of the agreement, the smart contracts automate the execution of the agreement enabling the participants to avail the outcome immediately without the intervention of a third party. Smart Contract development enables to replace the traditional contracts by binding them in a code that can be executed. Smart Contracts can also automate a workflow by triggering the next action once the conditions are met.Smart Contracts are based on Blockchain Technology and so the piece of code depicting the smart contracts is transparent to the users across the Blockchain network. Why Should Businesses Prefer Smart Contracts over Traditional Contract? Traditional Contracts involve one or more participants, many lawyers, and multiple rounds of negotiations leading to a long paper document that is to be signed by the participants involved for trust-building. While smart contracts are automatically executable codes that eliminate third-party interruption thus reducing the delay and errors caused.The traditional contracts are handled manually and thus can be tampered, and modified. The Smart Contracts once created and deployed can’t be tampered.Why Should Businesses Prefer Smart Contract? Uninterrupted AgreementsSmart contracts are the self-executable codes that operate under predefined conditions, thus eliminating the intermediary interruptions and ensuring direct or automated agreements. Transparency The information in the smart contract is accessible to all the users across the network, fostering trust or transparency amongst the usersReal-Time ExecutionThe execution of Smart Contract takes place simultaneously for all the participants across the systems, once the predefined conditions are satisfiedHighly ImmutableOnce the Smart Contract is created and deployed, it remains untampered i.e. it executes the programmed functions without modifications What are the Benefits of Smart Contracts? Smart Contracts eliminate the risk of manipulation of contracts by third parties since there are no intermediaries to confirm the agreement The smart contracts eliminate the involvement of third-party in the agreement ensuring a cost-effective solution Smart Contracts are encrypted and through cryptography, smart contracts protect the data from thefts Smart Contracts are automatically executed codes so they are free from human errors What are the Applications of Smart Contracts?Smart Contracts are disrupting the Industries with the potential to transform them into automation Pharma: In the pharma industry, smart contracts are used to safeguard the efficacy of medications by integrating transparency in the supply chain Finance: Smart Contracts are revolutionizing the finance sector by ensuring secure transactions and safe claim settlements Governance: The voting system through Smart Contract development is ledger-protected that enables a secure voting environment that is less susceptible to manipulationHealthcare: Blockchain-based smart contract has enabled the healthcare sector to store the encoded patient records with a private key, thus securing the confidential records Art: Smart Contracts make it possible to have a unique identification number for NFTs ensuring the NFTs are one of the kind and non-replicable.Wrap UpSmart Contracts are defined as a program or software executed when the predefined conditions are met. With Blockchain technology, smart contracts are being increasingly used in the Business world to ensure transparency in operations. If you are looking for a Smart Contract Development Company, RWaltz is the right choice for you! Explore our services and schedule a meeting with our technology enthusiasts.

How Can Blockchain Transform the Travel Industry?

Blockchain is transforming every industry and tourism isn’t untouched. Benefits, stability, and security play crucial role in the travel industry. The decentralized nature of Enterprise Blockchain implies heightened security of data against data breaches ensuring transparent transactions. The travel and tourism sector is based on the transfer of data between a wide range of companies. For example, the trip agents need to share the tourist details with the airlines and hotels while the tourist luggage is regularly passed and monitored. With Enterprise Blockchain Development services, storing and accessing data becomes easier. With monetary transactions being a crucial part of the travel industry, Enterprise Blockchain Development company plays a vital role to simplify and secure these transactions, especially for international transactions. Let’s dive in deep to take a look at the potential benefits of Enterprise Blockchain Development in tourism: Decentralized Marketplaces for BookingsWith travel agencies dominating the tourism industry, the tourists end up paying 15% commission to these intermediaries for their services. The decentralized system eliminates these intermediaries enabling direct communication between the tourist and the travel companies. Also, the Enterprise Blockchain offers transparency and reduces additional expenses, delivering a superior experience to clients.Acting as an automated intermediary for tourists, the smart contract offers multiple benefits to the clients. These self-executing contracts act as a computerized trip agent delivering a wide range of services. In addition, they can hold funds in escrow and release these funds only if clients are satisfied with the services. Tracing LuggageEnterprise Blockchain can play a vital role in tracking the movements of baggage, particularly when managing international travel. The decentralized architecture ensures efficient monitoring of luggage by sharing the tracking information between organizations seamlessly. Recognizable Identity ServicesIdentification services are tremendously valuable for the travel business, and Enterprise Blockchain Development Services might turn into the business standard for storing this data. The cutting-edge technology can reduce check-in times, or queues, as a simple retina scan or fingerprint can change the identity verification process. Secure and Traceable PaymentsThe significant application of Blockchain technology in tourism is secure payment transactions. The applications of Enterprise Blockchain have wide scope from being a global ledger, making transactions more secure and simpler to allowing travel organizations to utilize Bitcoin or other cryptocurrencies for their operations.Client Loyalty SchemesA wide array of travel organizations have client loyalty plans, to encourage return customers. A Blockchain Development Company can likewise help with these plans, improving the procedure, allowing clients to access data about their loyalty points more effectively, and allowing tokens to be shared. Travel InsuranceEnterprise Blockchain Development Company offers smart contracts to automate the decision-making process based on the data from the insurance company. There are multiple scenarios where a claim against a travel insurance policy is important. For example, in case of a lost bag or delayed flight, a smart contract utilizing this data stored on the decentralized network could spot the exact point of the claim's threshold and payout automatically.ConclusionThe travel business appears to be so ready for blockchain disruption as many intermediaries are involved between service providers and clients in a tourist’s journey. It will be fascinating to see how Blockchain development will accelerate the transformation in travel and tourism. Companies like RWaltz offer efficient Enterprise Blockchain Development Services across all industries. To know more take a look at the company profile.

How Blockchain Can Revamp the Petroleum Industry

With a large number of sectors embracing the Enterprise Blockchain Development, the petroleum industry has been slower to leverage. Undoubtedly, hunting underneath the earth's mantle for natural resources is a far leap from exploring how blockchain may profit the energy sector. But as the distributed ledger technology opened gateways for seamless operations into finance, automobile, healthcare, and agriculture; petroleum companies have begun exploring Blockchain Solutions. Let's take a look at how blockchain can benefit the petroleum industry: 1. Digitized Crude Oil Transactions- Using blockchain, raw petroleum transactions can be digitized that guarantees upgraded security, improved transparency, and enhanced productivity. Natixis, a French corporate bank, was the first to pioneer a blockchain solution in commodity trade for US petroleum exchanges. 2. Improved Trust Among Parties in the Business- A private blockchain system could securely store the track record of representative and contractual worker certifications (H2S preparing, first aid, welding, and so on). On boosting trust among organizations and contractual workers/representatives, such a blockchain system could help to cut down on recruiting costs while guaranteeing improved job security and execution. 3. A Cryptocurrency Pegged Against Oil- With oil being one the most important non-renewable source of energy on the planet, a digital currency pegged to it could be a reasonable replacement to traditional financial transactions. On this, such a cryptocurrency could empower the direct exchange of values between different parties in the business without the requirement for an intermediary like a bank.4. Augmented Compliance– The petroleum industry is among the most intensely regulated industries on the planet with protocols right from environmental to taxation. Regulatory authorities will have the option to boost visibility in the business as all the transactional information is stored on a blockchain that has real-time access.5. Upgraded Land Record Management- It is basic for petroleum organizations to appropriately manage land deal records that speak to a million dollars worth of investments. The traditional procedure of storing such a record is cumbersome and is inclined to fraud and other unlawful activities. Such a significant bit of documentation could be stored on the blockchain, which can make an immutable record of land ownership, transfer, and value. In Georgia and Ghana, where there are high levels of land ownership disputes, blockchain technology is being considered as a viable solution.6. Improved Information Storage for the Internet of Things- IoT is a system of interconnected computing devices or mechanical machines that can transfer information over a system. The petroleum industry depends intensely on IoT devices to screen tasks and increase their effectiveness. Despite being close to one another, these IoT devices need to transfer information over the web and intensely rely upon centralized storage solutions which could be on the radar of cyberattacks. To prevent a system from such attacks one can use a decentralized model that stores all the information in peer-to-peer fashion & hence provides more security & transparency to the system.7. Hydrocarbon tracking- Blockchain technology can be utilized to track regulated substances like hydrocarbons viably at each phase of the supply chain process. This can help to improve accountability in the business. Case HistoryWe came across a couple of advantages that Enterprise Blockchain offers to the petroleum industry. A leading Enterprise Blockchain Development Company, RWaltz Software Group Inc. has developed a blockchain-based decentralized marketplace called Afronix.The system is specifically developed for petroleum products and can solve security, safety, and transparency issues in traditional online marketplaces and change the way we buy and sell products online.The blockchain is a platform-like technology that consists of a decentralized ledger that records, verifies, and tracks cryptocurrency transactions and contracts between parties. Blockchain-based or decentralized marketplaces, in turn, are peer-to-peer networks that directly connect buyers and sellers without any intermediaries. This decentralized marketplace connects three groups of users: producers, sellers, and buyers. Just like with traditional online marketplaces, this decentralized marketplace seller offers product information and content about their petroleum goods. Buyers look for goods in the marketplace and make purchases.Since a blockchain-based marketplace removes intermediaries, all transactions are traceable on a public ledger, demonstrating a high level of security and transparency. In addition, this system involves smart contracts – digitally signed agreements made using distributed computing platforms like Ethereum. Smart contracts are stored publicly, preventing fraud. By joining a decentralized marketplace, producers, sellers, and buyers get the opportunity to sell and buy on a platform that offers a high level of trust and transparency and that lets them interact by their own rules with no restrictions imposed by third parties.Due to the decentralized model, there are no intermediaries between sellers and buyers in a decentralized marketplace. So who’s handling disputes and ensuring buyer and seller protection?Just like with traditional marketplaces, blockchain networks have agreements – only these agreements are smart contracts. Before making a purchase, a buyer and a seller agree on the terms and record those terms in a smart contract. With an escrow authorization, digital smart contracts can handle disputes and protect buyers and sellers.ConclusionWe have seen the benefits of how blockchain will soon transform the petroleum industry. The requirement for blockchain applications in petroleum will soon outpace solutions.The Blockchain Development Company addresses the requirements of this developing sector through this cutting-edge technology. If you have certain queries, book your slot immediately for Blockchain consultation with solution experts at RWaltz.

A 2022 Guide to Decentralized Finance Application

Decentralized Finance is reinventing the financial ecosystem facilitating a flexible and simple approach to access funds. Setting up new standards of access, resilience, and transparency; Defi is turning out to be a potential game-changer for the banking and finance sector. Let’s dive in deep to explore more about Decentralized Finance (Defi) What is Decentralized Finance (DeFi)? Decentralized Finance (Defi) is an emerging financial ecosystem working on blockchain that removes the control of intermediaries like banks and financial organizations on money, financial products, and services. Decentralized Finance facilitates people to make investments, international transactions, borrow and send money, etc. without the need to visit banks. What are the Features of Defi? Permissionless Following the permissionless access model unlike the traditional finance system, DeFi eliminates the conventional login model enabling access to DeFi solutions through internet connectivity and Crypto wallet. Decentralized The Decentralized nature of DeFi applications ensures each transaction is broadcasted to other users on the network enabling them to verify the transactions. Security Blockchain technology is integrated with multiple layers of security that prevents data breaches and abrupt shutdowns through the core operational nodes.Automated DeFi solutions are integrated with smart contracts that enable automatically executable mutual agreements between people preventing the occurrence of conflicts through automation.ImmutabilityImmutability in Decentralized Finance ensures the financial transactions in DeFi are untampered contributing to safe and secure data transmission.What are the Benefits of Defi for Small and Mid-sized Businesses? Crediting Decentralized Finance (Defi) lends money to the startups that offer collateral for borrowing and repay the debts once the project takes offStablecoinsStablecoins depict the tokens with an exchange rate attached to some real-world commodity. To avoid being a victim of exchange rate fluctuations, it is safe to keep funds in Stablecoins. Innovative SavingsDecentralized Finance introduced a new way for enterprises to manage and control their investments and savings enabling them to earn interest for locking their assets. What are the Applications of Decentralized Finance?Decentralized Finance has a wide array of applications in the banking and finance sector. Here are a few of them. Staking DeFi Staking refers to the locking of crypto assets into a Smart Contract as an exchange to be a validator in a Defi Protocol.Lending Defi lending enables issuing loans or depositing fiat by the investors and lenders for interest through a decentralized application structure. Borrowing DeFi borrowing allows a debtor to collect the loan through a decentralized system i.e. P2P lending deriving complete control of their funds. Finance Delivering seamless access to financial products through a public decentralized blockchain network, DeFi reduces the need for intermediary networks like banks.Investment DeFi is transforming the investment landscape with smart contracts deriving the security and transparency of the investments and ownership details. Decentralized Exchange PlatformDeFi ensures efficient management of crypto assets to yield higher performance in a decentralized exchange through smart contracts and management.Wrap UpDecentralized Finance facilitates seamless financial services to the public without the involvement of a third party. If you are new to DeFi, hopefully, the above article has enlightened you on what is DeFi.For a business looking for Defi development, RWaltz is the best choice! Take a look at our DeFi solutions and schedule a meeting with our tech experts to take your project idea to the next level.

How Blockchain Technology is Making the Gym Industry More Fit?

A weird yet Innovative Combination- Blockchain Technology and Fitness Industry! It is beyond our imagination how Enterprise Blockchain Development empowers the fitness industry. The Enterprise Blockchain Development is a robust technology that is transforming all the industry verticals including the fitness sector. A Forbes report says the Enterprise Blockchain Development Service is on the verge of changing the fitness sector. Let’s explore how Blockchain Development transforms the fitness industry. What is Enterprise Blockchain Development? Imagine a spreadsheet that is duplicated thousands of times across a network of computers. Then, imagine that this network is designed to regularly update this spreadsheet and you have a basic understanding of Blockchain Development.Enterprise Blockchain is a type of permission Blockchain network that is integrated and used for enterprise operations. Powered by scalability, security, accountability, control, and immutability; the Enterprise Blockchain Development Solutions deliver coherent, effective, and secure ways to do business. These Blockchain Solutions have turned out to be more advantageous to enterprises that wish to use Blockchain only for internal use. Blockchain technology is a database that continually updates and is effectively shared between devices. The data on the Blockchain technology isn't kept on one single PC or stored in a single place; rather it's continually open to the public, implying that there's no single point for a hacker to alter.How Enterprise Blockchain Benefits the Fitness Industry? A FIT token is the world's first platform that utilizes blockchain technology and runs on the Ethereal system. It is a decentralized way for individuals to purchase memberships and order things through mobile applications or the web, helping to build a more accessible environment for customers.A wide array of Blockchain platforms are currently offering rewards for utilizing their services. In case you're utilizing their blockchain and after completing certain workouts specified by them, you can be rewarded with tokens. Thus, people will be more interested in utilizing these services.How Blockchain is Helpful to Customers?Possibly you're not an entrepreneur and are thinking about how this can profit you as a customer. Well, in-person training at home can be difficult for schedule and timing, so smoother online training in terms of communication and payments through blockchain makes a healthy lifestyle more efficient. In addition, a few people don't like the gym environment. They would prefer not to interact with others or have awkward discussions with gym staff. Making the online environment with seamless payment processing and quicker ordering will make a healthy home environment convert to a gym easier.There's additionally nothing worse than a confusing contract where you discover you're locked in more than you wanted. As blockchain makes online agreements more transparent, clients can be sure about their memberships and payments.Rather than paying for the gym services in person, customers will access the blockchain which can give them similar benefits without going out. Everything's public and everything's open. Coaches and organizations can transfer their tips, programs, and other content to the blockchain which customers would then be able to download right to their home PC securely and safely.Wrap UpOrganizations and fitness centers benefiting from Enterprise Blockchain Development offer enhanced services to their customers. Considering all things, Blockchain is opening the door for online business, and the fitness industry is something that could determine a lot of advantages. Online currencies and blockchain platforms are not a big thing right now, it seems to be a booming technology in the future. Keep a check on this emerging technology to make sure that you keep upgrading and leading the competition. If you own a business & looking for blockchain experts who can help you transform your business idea into a sustainable blockchain solution? Choose a leading blockchain development company, RWaltz, having great experience in blockchain development which can take your business to the next level.

How to Choose Blockchain Development Company for your Project

Blockchain has marked a revolution into the business world with a wide array of opportunities to enhance efficiency and scale growth. Initially, Blockchain Development was just a buzz but now, multiple businesses have started embedding the technology into their operations. Transforming the major industries like healthcare, supply chain, finance, real estate, pharma, etc., Blockchain has paved way for the Digital economy too. According to a report by Statista, it is estimated that around 12 billion dollars will be spent on blockchain programming by the end of 2022.Multiple businesses are outsourcing Blockchain Development to automate business processes. It is crucial for businesses looking for Blockchain development Services to evaluate the Blockchain Development Company on the basis of expertise, resources, team, solutions, clientele, and service excellence. Before you lock a Blockchain Development Company for your project, dive in to check the criteria of choosing the services. Blockchain Consultation While hunting for a Blockchain development company, make sure the company you choose offers expert advice and an outlook to shape your project. Blockchain consultation will assist you at every phase of Blockchain development throughout the project enabling you to understand the business impact of integrating Blockchain solutions into your process. The company offering expert advice on Blockchain solutions understands your project idea, analyses your requirements and proposes the best Blockchain solution to satisfy your needs. Thus, it is important to have experts for Blockchain consultation who can assist you right from ideation to selection of the Blockchain protocol turning your aspiration into the business application. Customized Blockchain SolutionsPre-defined structured Blockchain solutions may not be always suitable to resolve all the business challenges. A complex business structure requires an individual approach to accomplish the requirements. Ensure the Blockchain Development Company has solution experts who understand your business requirements and propose the solution to meet your needs. If the company can help you draft a whitepaper to support the custom design with specifications will be an added advantage for you. Scrutinize the Website of the CompanyCheck the website smartly and look at what do they offer for Blockchain Development Services. Also, verify the content on multiple platforms where they have talked about their services. Analyze their client portfolio and check if they have served some big names from the industry.Before you choose the Blockchain Development Company, dive in deep to explore the client reviews on review websites. These reviews will help you to make a smart choice. Domain ExpertiseThe most popular application of Blockchain is in the finance sector i.e. cryptocurrencies. But, apart from finance Blockchain facilitates solutions to a wide array of industries. It is impractical to assume that every Blockchain Development Company has expertise across the industry verticals. So, to ensure your project takes off successfully, it is crucial to look for a company that has Blockchain expertise across multiple industries or predominantly in your business niche. Dedicated Team It is crucial to have a dedicated team working on your project, check if the company you choose serves you with a team of Blockchain experts. Confirm if the company is offering you Blockchain-certified and experienced professionals in various domains. Also, if the solution experts offer you round-the-clock services and have the potential to complete your project within the estimated deadline will be an added advantage. Wrap UpBlockchain Development Company plays a crucial role while you plan to integrate Blockchain into your process. Before you choose Blockchain Development Services, the above-mentioned tips will guide you to choose an appropriate Blockchain Development Company. Don’t fall prey to low-priced Blockchain Development Services rather, look for service excellence. If you are looking for a top-notch Blockchain Development Company, RWaltz is the right choice for you! Deep dive into our website and schedule a meeting with our solution experts to take your project ahead. We are one of the top blockchain development companies by TopDevelopers.co

DeFi 2.0 : The Next Revolution in Decentralized Finance

It’s not just Decentralized Finance but, now it’s DeFi 2.0 offering users a new source of passive income and greater autonomy. The continuous iterations in DeFi protocols fuelled the next generation of Decentralized Finance Development leading to DeFi 2.0. DeFi 2.0 refers to the subset of DeFi protocols native tokens experiencing liquidity constraints. Decentralized Finance Development Services are stepping ahead with DeFi 2.0 to address the risks present in DeFi Transactions. DeFi 2.0 mitigates the risks associated with crypto fluctuations by offering insurance to the liquidity providers who fund a liquidity pool with crypto assets. DeFi 2.0 ensures that smart contracts are free from critical errors by performing audits on the contracts. What is DeFi 2.0? DeFi 2.0 refers to the second generation of Decentralized Finance, that solves the challenges in the 1st iteration of DeFi. DeFi 2.0 is defined as an iteration of DeFi protocols to improve the shortcomings in DeFi. DeFi 2.0 Vs DeFi 1.0DeFi 2.0 was developed to resolve the shortcomings of DeFi 1.0. Let’s dive in deep to explore the difference between both the Decentralized Finance protocols Category Defi 2.0 DeFi 1.0 Connection Between Users Strong Connection Between Users. No Connection Between Users. Ecosystem It includes DAOs, and liquidity incentives that create, a warm sustainable, and decentralized interconnected financial architecture delivering capital efficiency. It has Decentralized trading applications, DEXs, lending and stablecoin applications, liquidity machine gun pool applications, synthetic assets, and insurance-type projects. Governance Pattern Governance and policy rights are delegated to the members. It has a democratic process that doesn’t rely on a powerful arbiter for decision-making. Scope for Innovation Unlimited scope for financial and technological innovations. One-way technology development and innovation. What is the Goal of DeFi 2.0? Unlike the earlier Decentralized Finance (DeFi) Developments, which were crafted focussing on users. DeFi 2.0 is developed more specifically for the business-to-business purpose. The main goal of DeFi 2.0 is to resolve the below-mentioned limitations of DeFi. Scalability: Decentralized Finance (DeFi) protocols on blockchains that have high traffic and gas fees offer slow and expensive services. These Decentralized Finance (DeFi) Developments often take too long for simple tasks and are cost-inefficient. Crafted on the latest blockchains like Polygon or Solana, DeFi 2.0 resolves the limitations on scalability. Oracles and third-party details: DeFi systems based on external details require enhanced quality oracles i.e. third-party data sources. This is resolved with Defi 2.0. Centralization: The Goal of Decentralized Finance Development Services should be an increased amount of Decentralization. But, the earlier generation of Defi Protocols doesn’t satisfy this. To address this limitation, DeFi 2.0 is integrated with DAO ensuring higher decentralization. Security: The periodic audits of DeFi Smart Contracts often lead to routine updates and software changes. This can cause outdated and redundant information even from credible DeFi security companies. Liquidity:Providing liquidity to a pool needs locking up funds and their total value. Markets and Liquidity pools are spread across multiple blockchains offering financial rigidity that leads to market inefficiency. Addressing this issue, DeFi 2.0 focuses on long-term liquidity through the OlympusDAO protocol. Which are the DeFi 2.0 Projects to watch for? Decentralized Finance has evolved to ensure an enhanced financial ecosystem. Here are a few DeFi 2.0 projects to watch for. Olympus DAOOlympus DAO is one of the leaders in DeFi 2.0. This Defi is referred to as a Decentralized Autonomous Organization (DAO) with OHM as its native token. Convex Finance Convex Finance (CVX) refers to a Decentralized Finance Defi Development built on top of stablecoin exchange Curve Finance (CRV). The reason users stake CRV tokens on Convex Finance is that it offers more rewards. Lido (LDO)Lido is a Defi 2.0 platform that refers to a staking solution on Ethereum. Lido’s staking solution enables users to stake ETH while avoiding asset locking requirements. Wrap upDeFi 2.0 is a movement in the Decentralized Finance Development that increasingly focuses on business-to-business operations. Hopefully, the above article has enlightened your knowledge of DeFi 2.0. For more details, feel free to connect with our experts.If you are looking for a robust Decentralized finance Development company, you are at the right place. Hurry up! Schedule a meeting with us and let’s take your project ahead.

Top Industrial Applications of Blockchain

Blockchain Applications mostly refer to cryptocurrencies and NFTs. But, applications of Blockchain across industries are way ahead of that. Simplifying industrial operations, Blockchain technology has turned out to be a cost-effective solution for enterprises. Why are Enterprises Leveraging Blockchain Solutions? To automate the business processes through smart contract development in Blockchain. Blockchain Development for companies enhances the efficiency and effectiveness of operations. Blockchain offers secure transactions and reduces data breaches. What are the Blockchain Applications Across Industries? Media and Entertainment The media companies are leveraging Blockchain Solutions to eliminate the issues related to Intellectual properties and copyright. A detailed analysis says the Blockchain market in the media and entertainment industry is estimated to reach $1.54 billion by 2024. Enterprise Blockchain Development enables artists and creators to digitize their unique content and store the IP rights on a time-stamped, immutable ledger. Blockchain Development for online streaming offers a consumer-friendly and usage-based consumption model. It allows consumers to pay for exactly what they want and also ensures artists receive the payments for their work. Government National, state, and local governments are using Blockchain technology to manage the massive amount of data. Blockchain development for the government safeguards this public data and simplifies maintaining records. With Blockchain technology, the tedious process of filing taxes becomes more efficient as it eliminates human errors with information stored on Blockchain.The voting system integrated with Blockchain technology ensures fair voting easing the roles of government employees. The technology attributes each vote to a government ID eliminating the possibility of generating fake votes and helping the government officials to tally the votes more efficiently and effectively. Insurance The insurance sector is leveraging Blockchain Solutions to drive down costs, increase speed to market and offer enhanced customer experience. Focussing on operational efficiency, blockchain-based insurance offers a single source of truth for transactions between parties driving down the processing time and costs. EY collaborated with Blockchain technology to develop Insurwave to craft a blockchain platform aimed at marine insurance. The solution creates an immutable database between shippers and insurers enabling better risk assessments and faster claim payouts. BankingBanking embedded with Blockchain offers peer-to-peer transactions enabling faster international transfers and monetary transactions. Lending and borrowing are an integral part of the banking ecosystem. Blockchain makes it easier as it offers instant settlements of transactions. The blockchain-based lending system executes collateralized loans through Smart Contracts. The smart contract development on blockchain enables automated service payment, margin call, full loan repayment, and collateral release. Blockchain Development offers decentralized exchanges which are faster and less expensive. In addition, these exchanges don’t require the central authorities to deposit the assets offering greater control and security to the investors. Real Estate Real-estate transfers require massive paperwork to verify financial information and ownership. The property transfer and titles to the new owners is a tedious and time-consuming task. Blockchain for real estate helps to record transactions, providing a more secure and accessible way of verifying and transferring ownership. These speed up transactions, reduce paperwork and save money. Wrap Up Hopefully, the article has enlightened your knowledge of Industrial Blockchain Applications. For further queries connect to our experts. If you are looking to integrate Blockchain solutions into your business operations, take a look at our Enterprise Blockchain Development Services.

Top Use Cases of Blockchain in the Education Sector

The adoption of Blockchain Technology is growing at a rapid pace across the industrial sectors. Blockchain gained momentum as the pillar of the crypto space but, today its applications are proliferating beyond the finance sector. Now, Blockchain has paved its way into the education sector too, with schools and colleges trying to understand the impact of Blockchain technology in their ecosystem. Blockchain For EducationA recent report by Gartner says, only 2% of higher education institutions are leveraging Blockchain Solutions, while 18% play to go with Blockchain Technology in the future. Blockchain offers secured data storage opportunities generating a wide array of benefits for the education sector. Schools, colleges, and universities are embracing Blockchain to improve the efficiency of student data management and craft a better way to engage learners. Also, Blockchain Technology enables stakeholders like employers to examine the validity of certificates provided by students. Here’s why the education sector is partnering with reliable Blockchain Development Company like RWaltz.Let’s dive in deep to explore more: Top Use Cases of Blockchain Technology in Education Student Record Maintenance The count of student records in every school or college is endless and it becomes difficult to manage this data. With its widespread application in record keeping, Blockchain technology reduces the efforts and time required to manage the massive amount of student data. It streamlines the verification process for transfers between schools and states thus saving the administrator’s time. The digital transcript with detailed information about the students like attendance, courses taken, results, etc. can be accessed to examine the learners. These Blockchain based student records ensure transparency between the education system, teachers, and the students. Courses and Certificates Course certification is the commonly requested student record in schools and colleges. This information is critical as it depicts of the student has passed or failed and should move from one academic level to another. The conventional education system requires manual stamps and multiple signatures to ensure accuracy which is time-consuming. Blockchain technology serves as a badge of achievement through transparent access to student grades across subjects and eliminating these labor-intensive processes. Since the credentials are stored on a distributed ledger, there are no intermediaries verifying the academic results, certificates, etc. These records can be acquired with just a few clicks. Fraud Prevention There have been cases where students have provided false certificates and academic records while interviewing for a company. This leads to unskilled employees being hired by a company and the performance of the team suffers. Blockchain Technology is adopted by institutions because it is resistant to fraud. The information is stored and recorded sequentially with an exact timestamp when it is added to the chain. The certificates or academic records on the chain can’t be altered, which makes tampering with or falsifying the certificates impossible. Decentralized Online Learning Every education institution has a unique specification for their study program that results in inconsistent course content. Also, students rarely have a take on the learning course and merely tend to attend the recorded lectures. Blockchain technology introduces real-time data exchange and interactions between students and teachers.Schools and colleges leverage Blockchain Platform to connect students and teachers. Blockchain technology also enables sharing study kits online and students can purchase a token to doubt resolution from standby tutors. The Blockchain-based platform enables downloading the study kits and lectures facilitating self-learning. Payment Processing Schools, colleges, and universities indulge in monetary transactions with parents, banks, and students for their fees, processing payments, scholarships, exam fee, etc. Education systems have now started collaborating with Blockchain Development companies like RWaltz to make this process smoother. In 2014, King’s College in New York started accepting cryptocurrency for student fees. By the end of this decade, we will surely find more and more education institutions accepting cryptos for fee processing. Wrap UP Hopefully, you have understood the applications of Blockchain Technology in the Education sector. Schools and colleges are integrating Blockchain solutions to ensure transparency with student record management, enhanced the learning experience through seamless teacher-student interaction, prevent certificate faking and eliminate long processes and heavy paperwork. Looking for a reliable Blockchain Development Company? You are at the right place! Just scroll to our Enterprise Blockchain Development Services and request a consultation from us right away!

How Blockchain Technology Enhances Mobile App Security?

The technological revolutions have not only introduced new ways of doing business but have also transformed the way hackers breach security. Mobile application security has always been the main concern where users hesitate to share their login details. Blockchain technology has turned out to be an ideal way to strengthen mobile application security. In this era of Digital Transformation, Blockchain solutions are offering robust security to mobile apps. Why Leverage Blockchain for Mobile App Security? Smartphones with advanced features have security loopholes too. We cannot rely on security software to keep hackers away. Blockchain technology acts as a protective shield against hacking maintaining safety standards. Since Blockchain records are immutable, it is impossible to alter the data in the system. Blockchain guarantees 100% data transparency among the stakeholders for mobile app security. The simplicity of Blockchain technology and its ease of access is the main reason for its proliferation in the business world. If you wish to develop your software on Blockchain Technology, take a look at our Blockchain Development Services. You Shouldn't Miss Out on these top 5 Security Benefits of Blockchain Data Transparency Blockchain’s decentralized ledger is one of the popular benefits as it enables users to take control of all the data. It enables all the stakeholders to make edits to the document in the ledger eliminating fraudulent errors. If any stakeholder makes changes to the data, the edits will be reflected by all the stakeholders in the application. This makes the application data transparent and secure. Password Free Applications Passwords have turned out to be an integral part of application security, the hackers can break through them easily. It doesn’t matter if the password is tricky or not, smartphones are still vulnerable to a security breach. Blockchain Technology eliminates the need to integrate passwords in the system leading to password-free software making it nearly impossible to hack.Secure Mobile Payments Blockchain enables peer-to-peer transactions delivering quick, secure, and contactless payments. To make a secure payment, the user needs to share the other party’s account details and complete the transaction. The peer-to-peer network has turned out to be the most secure and affordable system for payment processing. Secure Mobile App Infrastructure Blockchain Technology integrated into an application allows the developers to store DNS entries on a decentralized platform. A security breach into the system is close to impossible, as the user data is controlled by the system and the transparent DNS protects the system. Keyless Security InfrastructureKeyless Security Infrastructure is used to store all data in cryptographic hash form. For verification, the hashing algorithm can be used. The main reason to use the algorithm is that any manipulations can be identified and monitored in real-time, offering superior mobile app security.Wrap Up Hopefully, the above article has enlightened your knowledge of Blockchain Technology for mobile app security. For more queries, connect to our team. If you are looking for a reliable Blockchain Development Company, you are at the right place. Hurry up! Talk to our experts now!

Make Your Blockchain Move with these Data-Driven Insights!

Blockchain Technology redefines the technology space with the highest levels of security, efficiency, and accuracy. It is formally defined as a decentralized and distributed ledger. The Simplest Explanation of Blockchain Technology Blockchain is termed as a shared and immutable ledger facilitating the seamless recording of transactions and monitoring assets across a business network. A Blockchain network is made up of blocks, where every block signifies the recorded data. These blocks are linked together through cryptographic algorithms ensuring heightened security of data. Scroll Yourself to the Interesting Blockchain Numbers! The yearly spending on Blockchain Development services is increasing steadily. The future is close when this technology will dominate the business world. The table depicts the Global investment in Blockchain solutions yearly.Here’s the Dissection Report of a Block for You! Every block in the Blockchain consists of three parts. Let’s explore them: Data:Blockchain transaction information like date, time, transfer Block size, Transaction count, and transactions are included in it. Previous Hash:The hash of the previous block helps to create a linear chain of blocks in chronological orderCurrent Hash: The cryptographic hash is also known as block hash or current hash and is the primary identifier of the block. Blockchain Technology Benefits Making It a Cutting Edge TechnologySecurity: Blockchain technology uses cryptographic algorithms to encrypt the stored information ensuring heightened security. The data is encrypted in a code that has no meaning and is difficult to crack. Immutable: Blockchain technology is immutable and hence the data recorded in the blocks can’t be modified or altered by malicious parties or hackers. If one block is altered the whole chain has to be altered which is technically very hard or even impossible to do. Decentralized:Blockchain technology doesn’t have any governing central authority or middleman to control the data and assets. Since it is decentralized in nature, the transactions are spread across thousands or even millions of nodes in the network ensuring more autonomy or freedom to lower levels.Transparent:With Blockchain being a distributed ledger, all the information in the network can be accessed by everyone across the nodes. A change made on one node can be viewed by users across the Blockchain network. Easy and Fast information transfer and open to allWe Bet You Didn’t Know This About Blockchain Developers! Developers with in-depth knowledge of Blockchain Architecture who craft blockchain-based applications are defined as Blockchain developers. Let’s look into the types of Blockchain Developers: Core Blockchain Developers They will design the architecture of the ecosystem. This responsibility involves making decisions like Blockchain design and consensus mechanism. These developers are also responsible to handle security conventions. Blockchain Application Developers These developers are also known as decentralized software developers who create Blockchain applications or DApps. These developers must have knowledge of smart contracts before moving ahead with Blockchain development or DApp development. Blockchain 2022 Fact You Need to Ponder On! The industrial blockchain market size augmented to $85.64 billion in 2022. Here’s a list of the top 5 companies using Blockchain technology. Source: Forbes (https://bit.ly/3BO9xC3) RWaltz- A Hub for Customized Blockchain Development Services! Carrying a vast experience in Blockchain development, our technology experts understand your requirements, analyze your industry needs and propose a solution to meet your business goals. Clients across business verticals trust us for reliable development servicesTo know more about our Blockchain Development Services, click here. Let’s ConcludeHopefully, the above article has enlightened your knowledge of Blockchain development. For further queries, connect to our Blockchain experts. If you are looking for a Blockchain development company, we can be the right choice for you. Hurry Up! Talk to us now!

Sidechains- A Boon for Blockchain Community!

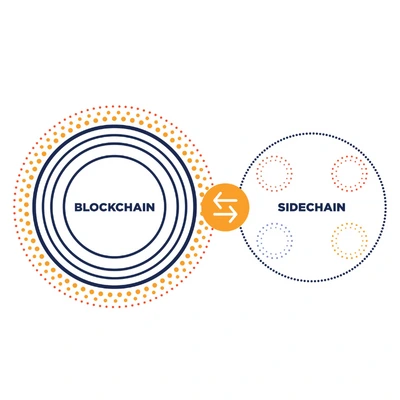

Blockchain technology is evolving day by day with new tech trends adding to the space. Sidechains are considered to be the latest mechanisms that carry the tremendous potential to enhance the existing capabilities of the current blockchains. Let’s Discover What are Sidechains in Blockchain Development! A Sidechain is defined to be a separate blockchain network that links to a different blockchain i.e. the parent blockchain through a two-way peg. A crucial element of Sidechains is their ability to ensure smoother asset exchange between the secondary blockchain and the parent blockchain. This parent chain is referred to as the main chain or the mainnet. The secondary blockchains carry their own set of consensus mechanisms facilitating the blockchain network to enhance privacy and security. Sidechains are termed to be separate blockchains that branch out from the main chain. Side chains are often connected to the main chains through a two-way peg. Potential use cases of Sidechains are mainly in Blockchain Scaling Solutions. RWaltz is one of the leading Blockchain Development Companies that offer customized solutions based on your business demands. Crucial Components of Sidechains You Need to Explore! A Two-way PegThe development of sidechains was aimed to facilitate digital asset transfers between the blockchains irrespective of the owner or holder of the assets. There should be a smooth transfer of digital assets without any third-party or secondary actor pausing the transfer. Here, a two-way peg becomes important to facilitate the seamless transfer of digital assets between blockchains. A Two-way peg is termed as the mechanism through which coins are transferred between the sidechains. It is like a tunnel that connects both the parent chain and the side chain enabling coin transfers back and forth. Source: https://www.coindesk.comSmart Contracts It is interesting to note that, digital asset transfer is imaginary where the assets aren’t actually transferred. The assets are locked into the mainnet i.e. the parent blockchain and the equivalent amount is locked into the sidechain. These assets are locked and released on either end of the blockchains once the smart contracts validate the transactions. Smart Contracts play a key role in minimizing foul play by the enforcing validators on the parent blockchain and sidechain. The smart contracts notify the transactions to the parent blockchain once the transaction has occurred. Now, the off-chain process communicates the transaction information to the smart contracts on the sidechain and verifies the transaction. Once, the funds are verified by the smart contracts the digital assets can be transferred across both blockchains. Image Source: https://www.coindesk.com/Let’s Dig into the Roots of PolygonPolygon is an Ethereum layer 2 solution based on the concept of Sidechains. It leverages the Ethereum framework termed Plasma, which enables the creation of child chains. These chains facilitate transaction processing before being finalized on Ethereum Blockchain. Polygon is EVM compatible and issues its own native token i.e. Matic through the proof-of-stake validators. It features 2 Two-way pegs, out of which one is through Plasma and the other through Proof-of-stake Validators. At RWaltz, we have a team of experts working on polygon blockchain. We work on the latest technology trends and provide customized Blockchain Development to our esteemed clientele. Our RWaltz Whitelabel NFT Marketplace is built on Polygon Blockchain. Click here to explore our Blockchain Development services. Let’s Wrap UpHopefully, the above article was informative and has helped you resolve your queries on sidechains. If you are looking for a reliable Blockchain Development Company, we can be the right choice for you! Explore our Enterprise Blockchain Development Services and schedule a meeting with us now!

DeFi Insights That Have Unlocked the Fintech Potential!

The Fintech sector is on the rise and Decentralized Finance (DeFi) is leading this race. DeFi development is the new normal in fintech with more than $210 Billion value locked in crypto assets across multiple DeFi platforms in 2022. Let’s Try to Understand Decentralized Finance (DeFi) in Depth! DeFi is the short form of Decentralized Finance, which is an emerging technology in the fintech sector. DeFi is a collective term for financial services on public blockchains, mainly Ethereum. It is similar to banks with a major difference in that no intermediaries or a centralized authority are controlling your financial transactions. DeFi allows people to borrow, lend, purchase insurance, trade derivatives, trade digital assets, earn interest, and more, eliminating documentation and third-party intervention with the help of Blockchain Technology. If you are looking for a reliable DeFi Development Company, we are the right choice for you! Develop a customized DeFi platform with us and launch it now! 4 Key Elements of DeFi You Should be Curious to Know! Decentralized Finance Development takes place on different technology layers or DeFi tech stacks. Each layer refers to a specific function of the DeFi application ensuring secure transactions across the Blockchain network. These DeFi key elements offer functionalities that facilitate transparent, secure, and immediate transactions. Settlement LayerThe settlement layer formulates the base of the DeFi infrastructure. It is termed layer 0 because it comprises a public blockchain network and a particular cryptocurrency to support the transactions. Most of the DeFi developments take place on Ethereum Blockchain where Ether is used as the native currency. A few DeFi applications use a tokenized version of digital assets delivering a fractional value of physical or real-world assets. Protocol Layer Though the Decentralized Finance Application operates without a centralized regulatory body, the transactions through the platform adhere to pre-defined rules. The protocol layer plays a crucial role here. It consists of pre-defined rules supporting interoperability between multiple DeFi services. These DeFi protocols prevent monopoly by any party into the DeFi system. Application Layer The application layer refers to the front end of the DeFi application that abstracts the functionality of the protocol layer. It offers users with intuitive services and functionalities delivering a seamless experience. Aggregator LayerThe secret behind the rapid adoption of DeFi is various services aggregated on a single platform to add value to Crypto enthusiasts. This layer is called an aggregator. It integrates a variety of financial services in the application layer and offers an uninterrupted transaction experience. Top 4 Reasons Decentralization Will Be the Future of Financial Ecosystem! Reduced Costs:DeFi eliminates the cost associated with the central systems like brokerage costs, maintenance costs, setting up centralized servers, etc. Thus, DeFi is a cost-effective solution over the traditional financial system.Enhanced Security:Decentralized Finance eliminates the central point of failure and offers 100% uptime delivering enhanced security. Peer-to-Peer Network:Offers quick and immediate transactions as there is no central authority controlling this process. Improved Privacy: The data is distributed across all the nodes in the network in an encrypted form ensuring the privacy of confidential data. Wrap Up Hopefully, the article was insightful. Confused about how to take the initial step for DeFi Development Services? Don’t scratch your head, we are here to resolve your confusion.

Top 3 Blockchains to be Considered for Token Development

It is almost a decade now; the tech world has acquainted us with Blockchain technology. Blockchain solutions have turned more popular among industries and start-ups. Blockchain development has its use cases in healthcare, pharmaceutical, logistics, trading, real estate, finance, retail, and much more. Decentralization, security, and transparency have laid the foundation for the success of Blockchain technology. With Blockchain, tokens have also turned out to be a vital asset in the crypto space. Let’s dive in to explore more! What Do You Understand by Token Development? Token refers to a digital asset that has a specific value and can be used for exchanging or services. Token development is defined as a process that comprises a set of sequential stages to design and develop crypto tokens on various Blockchains. With the evolving Blockchain networks, token development is getting complicated with feature-rich tokens being launched in the market. Let’s explore the Blockchains to be considered for Token Development! Top 3 Blockchains to be Considered for Token Development! Ethereum Ethereum refers to a decentralized Blockchain that builds a peer-to-peer network. Its native currency is Ether and its token standard is ERC (Ethereum Request for Comments). There are different ERC token standards like ERC 20, ERC 721, and ERC 1400. Here’s why you should choose Ethereum for Token Development: Tokenize Assets: Ethereum offers easier tokenization by enabling businesses to fractionalize the earlier monolithic assets like real estate, unlock new incentive models, and expand products. Rapid Development: The developers can quickly build and administer private Blockchain networks through an all-in-one SaaS platform such as Hyperledger Besu, instead of building the blockchain from scratch. Decentralization: The decentralized nature of Ethereum ensures there is no central authority to govern the token, thus ensuring more transparency and security. Binance Smart Chain Binance Smart Chain (BSC) refers to the advanced version of the Binance chain. It was developed to overcome the drawbacks of the Binance chain. It is defined as a unique Blockchain that is compatible with Ethereum Virtual Machine (EVM). This makes it easier for developers to build ETH-based applications on BSC. Here’s why it can be the best match for token development: Cross-chain Compatible: The dual-chain architecture of BSC ensures hassle-free transfer of assets from one blockchain to another which is perfectly suitable for token development. Staking: BSC can handle ultra-fast transactions of crypto assets ensuring easier and quick staking of coins, which has led to the growing prevalence of BSC for developing tokens. BEP-20 Token Standard: BSC offers a BEP-20 standard for token development, which is an extension of ERC-20. This BSC token standard offers multiple functionalities like token holder control, balance recovery, token transfer, etc. which makes it one of the preferred Blockchains. Polygon In 2017, the Polygon network was created to overcome the several complications faced like transaction speed, cost, etc by a variety of Blockchains. Polygon offers the benefits of a combination of Blockchains and helps developers to build user-friendly DApps. This platform was initially titled, Matic. Let’s dive in to explore why Polygon should be preferred for token development.Green Blockchain Network: Polygon has gone zero carbon since 2017 and has turned out to be an environment-friendly blockchain. ETH Compatible: Polygon is ETH compatible, which makes it easier for developers to deploy applications on polygon just with slight advancements. Transaction Speed: Polygon offers high transaction speed with instant transactions as compared to other Blockchains. RWaltz- Pioneers in Blockchain development for tokens! We at RWaltz are pioneers in developing tokens on all Blockchains. We have in-house Blockchain experts working on Blockchains like Ethereum, BSC, Polygon, Corda, Solana, Polkadot, Tron, and EOS. If you are looking for a Blockchain development company, with expertise in developing tokens on these Blockchains, we can be the right choice for you. Hurry up! Launch your own token with the Blockchain experts. Wrap Up Hopefully, the above article has enlightened your knowledge of top Blockchains for token development. Apart from Ethereum, BSC, and Polygon; a variety of Blockchains can be used for developing the tokens. The Blockchains like Corda, Solana, Polkadot, Tron, etc can also be the best match for your token. Do your own research and develop your token on the best Blockchain that suits your requirements.

How Blockchain Technology Bolsters Government Ecosystem?